Why the Market Is Obsessed with Interest Rates

The increase in interest rates has a ripple effect on the economy and the stock market (SPXL).

April 5 2017, Published 11:37 a.m. ET

Direxion

The Fed raised rates by 0.25% on March 14th, for just the third time since 2006. Oddly enough, the increase was actually seen as dovish by traders. That’s because, along with the increase, Fed Chair Janet Yellen said monetary policy will remain accommodative “for some time.” The Fed is still willing to let inflation rise above 2% before taking a more aggressive path. So even as nominal rates rise, real rates are headed into negative territory. Investors and financial media tend to obsess about interest rates. That’s because when the FOMC changes rates, it has a ripple effect across the economy, and securities markets. But while it usually takes months for a rate change to affect the economy, the markets’ response is usually more immediate.

Market Realist

Interest rate movement has a ripple effect on the economy

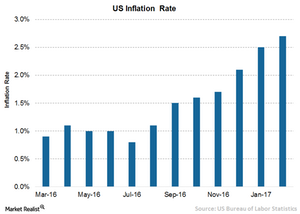

As expected, the US Federal Reserve raised key interest rates by 25 basis points to between 0.75% and 1.00%, which was the second such hike since December and the third since 2008. The interest rate hike came about due to the higher inflation expectations in the medium term, steady economic growth, and strong job gains.

Robust economic indicators

According to the US Labor Department, consumer prices jumped 2.7% over the past year, while prices of several key categories soared above the headline inflation rate. Housing costs rose 3.5% during the year, while the cost of medical treatment climbed 3.4%. Inflation is expected to hover at around the central bank’s target rate of 2% over the medium term. On the other hand, US job growth continued to rise and has averaged 209,000 per month from December to February. Job growth is well above the threshold of ~100,000 jobs per month needed to match the growth in the working age population. The US economy exhibited decent growth in the last quarter of 2016. GDP growth is expected to get a boost from proposed higher infrastructure spending, tax cuts, and fewer regulations. The FOMC (Federal Open Market Committee) expects GDP to grow at 2.1% in 2017.

Positive impact on stocks

The increase in interest rates has a ripple effect on the economy and the stock market (SPXL). Though the impact on the economy is expected to be felt after a lag, stock market (TNA) movement depends on the nature of future rate hikes and other variables. The Fed’s decision has a positive impact on stocks because future rate hikes are expected to be less aggressive.

Rising interest rates are generally considered to be negative for the stock market since they increase companies’ borrowing costs. However, not all sectors are negatively impacted by rate hikes. For banks (DPST) (WDRW), higher rates mean higher income from lending activities, enhancing their net margins. On the other hand, for consumer discretionary companies, higher rates mean lower consumer spending, affecting their top lines.