An essential guide to Exxon Mobil: XOM’s major areas of operation

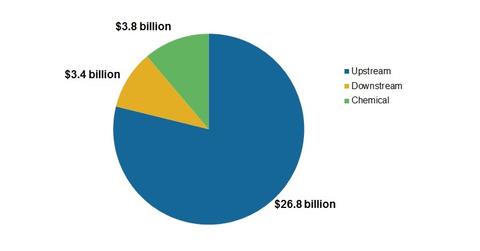

Exxon Mobil has three major business segments: Upstream, Downstream, and Chemical. Upstream contributes the most to XOM’s earnings.

Nov. 20 2020, Updated 5:16 p.m. ET

Major areas of operation

Exxon Mobil has three major business segments, described below.

Upstream (last 12 months ending December 31, 2013, earnings of $26.8 billion—79% of 2013 earnings)

This segment explores and produces crude oil and natural gas. Upstream operations can generate higher earnings when production volumes increase, oil and gas prices increase, and the cost of exploration and production decreases. Conversely, if production and commodity prices decline and costs increase, this negatively affects upstream segment earnings. Production volumes depend on Exxon’s ability to explore and find new hydrocarbon assets, and the company’s subsequent ability to execute on developing these assets to viably produce oil and gas. Oil and gas prices are affected by global supply and demand factors, such as economic growth and worldwide oil and gas production.

Downstream (last 12 months ending December 31, 2013, earnings of $3.4 billion—10% of 2013 earnings)

This segment produces petroleum products and it transports and sells crude oil, natural gas, and petroleum products. Downstream operations can generate higher earnings when the price of refined products (such as gasoline, heating oil, diesel oil, and jet fuel) increases relative to crude oil. One proxy for this measure of profitability is called the “crack spread.” For more on this spread, please see our Market Realist series Crack Spread 101. Prices for these commodities are affected by various factors, which XOM lists as “global and regional supply/demand balances, inventory levels, refinery operations, import/export balances, currency fluctuations, seasonal demand, weather and political climate.” Plus, downstream operations can be hurt if refineries experience high amounts of downtown. (It’s normal for refineries to undergo expected periodic maintenance, but sometimes maintenance may take longer than expected, or other operational hiccups and accidents can occur.)

Chemical (last 12 months ending December 31, 2013, earnings of $3.8 billion—11% of 2013 earnings)

This segment produces and markets petrochemicals such as olefins, aromatics, polyethylene, polypropylene plastics, and other specialty products. Chemical operations can generate higher earnings when production volumes increase, and prices of petrochemicals increase relative to input costs (such as ethane and propane). Prices relate to global demand for petrochemicals, which are inputs into various products such as plastics and lubricants.