Why household formation drives homebuilder demand (Part 2)

Continued from Part 1 The state of the first-time homebuyer The first-time homebuyer has been in a difficult position post-crisis. Many college students graduated with high levels of student loan debt and grim job prospects. Given the harsh job market, many graduates decided to return to school, moved in with their parents, or moved in […]

Dec. 4 2020, Updated 10:53 a.m. ET

Continued from Part 1

The state of the first-time homebuyer

The first-time homebuyer has been in a difficult position post-crisis. Many college students graduated with high levels of student loan debt and grim job prospects. Given the harsh job market, many graduates decided to return to school, moved in with their parents, or moved in with roommates. Youth unemployment has been particularly high during this recession. Many college graduates find themselves in jobs that don’t require a degree, and they’re paid a high-school graduate wage.

An additional issue with the first-time homebuyer stems from the easy credit of the bubble years. Many first-time homebuyers were able to purchase a home with little or no money down. Historically, the first-time homebuyer had to come up with a downpayment and either borrowed from parents or saved. The easy credit allowed many homebuyers who would have taken a few years to save up a downpayment to purchase a home immediately. This had the effect of “borrowing” demand from the future.

Another issue with the first-time homebuyer has been student loan debt. Historically, someone with a college degree was more likely to own a home than someone without a degree. This made sense—people with degrees typically earn more than people without degrees and are more likely to have the financial wherewithal to purchase a home. Today, that dynamic is reversed. If you have a college degree, you’re less likely to own a home versus someone without a degree. Why? Student loan debt. Given the high levels of student loan debt, many graduates fail the debt-to-income ratios (known in the industry as DTI) that banks use to determine whether a borrower can afford to pay back a mortgage. The qualified mortgage rule out of the Consumer Financial Protection Bureau codified a 43% DTI as the threshold for affordability. If a lender gives a mortgage to someone without a DTI ratio over 43%, the borrower can claim that the lender knew they would be unable to pay off the loan and so shouldn’t have lent the money. Borrowers could use this accusation as a way to renegotiate principal if the borrower defaults.

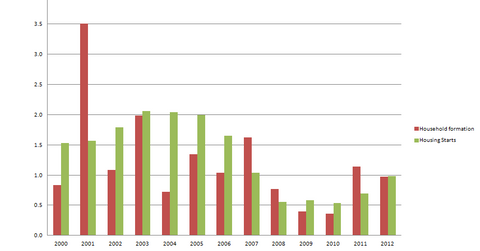

Household formation numbers

This analysis continues in Why household formation drives homebuilder demand (Part 3).