Primer on mortgage backed securities, Part 3

Continued from Primer on mortgage backed securities, Part 2. Basic mortgage backed securities: Fannie Mae, Freddie Mac, and Ginnie Mae Most mortgage backed securities are agency securites, which means they are associated with government guaranteed loans. Fannie Mae and Freddie Mac are government sponsored entities (GSE’s) and do not carry an explicit government guarantee like Ginnie Mae mortgages do. […]

Nov. 20 2020, Updated 4:08 p.m. ET

Continued from Primer on mortgage backed securities, Part 2.

Basic mortgage backed securities: Fannie Mae, Freddie Mac, and Ginnie Mae

Most mortgage backed securities are agency securites, which means they are associated with government guaranteed loans. Fannie Mae and Freddie Mac are government sponsored entities (GSE’s) and do not carry an explicit government guarantee like Ginnie Mae mortgages do. As a result, Fannie and Freddie mortgage backed securities trade at lower prices (higher yields) than Ginnie Maes. The starting point for mortgage backed securities is what is called the To Be Announced (TBA) market. A mortgage originator will deliver funded loans into a TBA mortgage backed security. The buyer of that security will not know the terms of the actual loans underlying it until it actually settles. All the buyer knows is that the loans that will be delivered to that security have a certain range of coupon payments and conform to the rules and regulations of the guaranteeing agency.

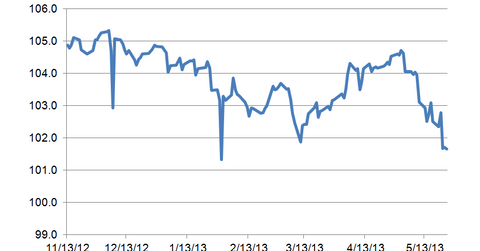

Agency MBS will cover any number of different types of mortgages. There are separate MBS for Ginnie Mae 30-year fixed rate loans (which covers FHA, VA, USDA loans), Fannie Mae 30-year fixed rate loans, Freddie Mac 30-year fixed rate loans, and then separate ones for 15-year fixed rate loans, and then adjustable rate loans as well. The chart above shows the prices of the Fannie Mae 3% TBA, which contains 3.25% to 3.75% Fannie Mae 30-year fixed rate mortgages.

MBS and Fed asset purchases (quantitative easing)

When you hear of the Fed conducting asset purchases under quantitative easing, they are purchasing these TBA mortgage backed securities. Every month, the Fed puts out a report where it lists the exact MBS they purchased and when. So far, they have been purchasing $3 billion worth of MBS a day, with a concentration on Fannie Mae and Freddie Mac securities.

The purpose of purchasing mortgage backed securities is to lower the rates that originators are charging their borrowers. Every mortgage company puts out a rate sheet which lists the rates and corresponding points to be charged each borrower. In other words, a borrower may have a number of options where they can lock in a low rate, but the borrower is forced to pay points up front; there are other options where a borrower can lock in a higher rate and get a check from the originator to cover closing costs. The starting input to all of these rate sheets is where TBA MBS are trading in the market. When the TBAs increase in price, originators that refuse to move with the market find themselves priced out of the market. So generally, a rally in MBS lowers rates charged to borrowers.

Continue to Part 4.