Why Ralph Lauren Is Having a Tough Time

Ralph Lauren (RL), which is scheduled to report its third-quarter results on February 1, is expected to post another quarter of top-line declines.

Jan. 24 2018, Updated 5:35 p.m. ET

What’s behind Ralph Lauren’s plunging top line?

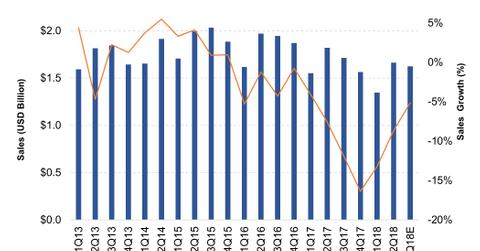

Ralph Lauren (RL), which is scheduled to report its third-quarter results on February 1, is expected to post another quarter of top-line declines. Management has projected a 6% to 8% fall in sales, excluding 160 to 170 basis points of foreign currency benefits. Wall Street, in comparison, is looking for a 5.6% YoY (year-over-year) decline.

If results land around expectations, then the third quarter would mark the eleventh straight quarter of sales declines for the company. Rising competition, a highly promotional environment, and Ralph Lauren’s struggle to resonate with customers have hit the brand’s sales in the recent past. Higher off-price sales and an increased presence in outlet stores negatively impacted the brand’s image and sales comps. RL’s same-store sales have declined for the last 11 quarters.

“The brand became stale relative to peers, and was watered down by outlet and off-price-distribution,” said Bank of America Merrill Lynch analyst Heather Balsky in December.

What’s the company doing to get back in shape?

Ralph Lauren’s management is working on its strategic initiative called the Way Forward Plan, which focuses on rebuilding the brand’s image. Under this plan, Ralph Lauren has been reducing shipments in the wholesale channel, exiting unprofitable brands, lowering off-price sales, and closing underperforming doors.

The initiative resulted in 70% of the 22% decline recorded in the North America wholesale business in 2Q18. While the initiative has moved RL back to profitability, it hasn’t been able to pull the company back to growth. Read the next part of this series to see how RL’s sales are expected to change in the near term.

ETF investors interested in getting exposure to Ralph Lauren can consider the Guggenheim S&P 500 Equal Weight Consumer Discretionary ETF (RCD), which invests 1.42% of its portfolio in the company.