Eastman Chemical’s Demand for Tritan Continues to Grow in Asia

The demand for Eastman Chemical’s Tritan continues to grow.

Jan. 16 2018, Updated 10:56 a.m. ET

Eastman Chemical’s Tritan

The demand for Eastman Chemical’s Tritan continues to grow. On January 11, 2018, Dewan & Sons, an India-based company, selected Tritan copolyester for its new beverage dispensers. The new dispensers are cone-shaped and blend well with metal features, which give a modern look and make the product tougher.

These dispensers are sold at Tablekraft, Sams Club, and other department stores. Surendar Gandhi, the director of Dewan & Sons, said, “With previous beverage container designs that featured glass and other Plastics materials, we’d receive complaints of breakage during transportation and usage, and of haziness after cleaning. By using Tritan, we’re able to satisfy the needs of our customers in terms of safety, aesthetics and long-term satisfactory performance. We’ve been using Tritan in our designs for more than five years and are pleased to continue to work with Eastman to develop innovative products.”

Update on stock performance

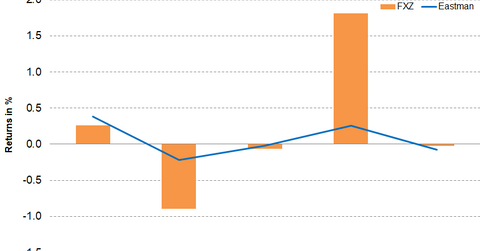

Eastman Chemical gained a marginal 0.30% and closed at $97.43 for the week ended January 12, 2018. EMN closed at an all-time high and traded 8.4% above the 100-day moving average price of $90.02. Analysts’ view on Eastman continues to be bullish. Analysts have recommended a target price of $101.56, which implies a return potential of 4.3% from the closing price as of January 12, 2018. So far in 2017, the stock has moved up by 5.2%. However, investors need to be cautious, as EMN’s 14-day relative strength index is at 71, which indicates that the stock has temporarily moved into an overbought situation, and EMN could face some selling pressure in the coming days.

Investors can indirectly hold Eastman by investing in the First Trust Materials AlphaDEX Fund (FXZ), which has invested 3.4% of its portfolio in Eastman Chemical. The fund also provides exposure to Cabot (CBT), Westlake Chemical (WLK), and LyondellBasell (LYB), which have weights of 3.6%, 3.5%, and 3.5%, respectively, as of January 18, 2018.