US Dollar Index Is Weak in the Early Hours on November 17

The US Dollar Index started Friday on a weaker note and traded below the opening prices with weakness in the morning session.

Nov. 17 2017, Published 8:22 a.m. ET

US Dollar Index

After breaking the three-week gaining streak last week, the US Dollar Index started this week on a mixed note. The US Dollar Index lost strength as the week progressed but regained ground on Thursday. Despite rebounding on November 16, the US Dollar Index started Friday on a weaker note and traded below the opening prices with weakness in the morning session.

Market sentiment

The sentiment in the US Dollar Index was weak at the beginning of the week amid increased concerns about the timing and execution of the tax cut plan. October’s weaker-than-expected retail sales data also weighed on the US Dollar Index. It regained strength on Thursday despite weak jobs data. The House of Representatives passed the tax cut plan, which is expected to support US companies’ earnings. According to the US Department of Labor, =US initial jobless claims rose to 249,000 in last week, which is higher than the expected reading of 235,000.

At 5:35 AM EST on November 17, 2017, the US Dollar Index was trading at 93.68—a fall of 0.27%.

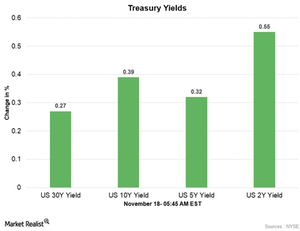

US Treasury yields

After falling for two consecutive trading days, US Treasury yields regained strength on Thursday amid the decline in bonds. The increased risk appetite had a negative impact on bonds and supported yields that move opposite to bonds. US Treasury yields are stable in the early hours on Friday.

Movement in Treasury yields

Below are the movements in Treasury yields as of 5:40 AM EST on November 17.

- The ten-year Treasury yield was trading at 2.370—a rise of ~0.31%.

- The 30-year Treasury yield was trading at 2.814—a rise of ~0.3%.

- The five-year Treasury yield was trading at 2.068—a rise of ~0.16%.

- The two-year Treasury yield was trading at 1.721—a rise of ~0.55%.

The iShares 20+ Year Treasury rose 1.9% on November 16.

In the next part of this series, we’ll discuss how commodities performed in the early hours on November 17.