Shareholders Approve Quaker Chemical and Houghton Combination

On September 7, 2017, Quaker Chemical (KWR) shareholders approved the company’s combination with Houghton International.

Sept. 12 2017, Published 7:44 a.m. ET

Shareholders give a thumbs up

On September 7, 2017, Quaker Chemical (KWR) shareholders approved the company’s combination with Houghton International. Quaker Chemical expects the transaction to be completed by the end of 2017. On April 5, 2017, both of the companies agreed to the combination. According to the agreement, Houghton International will receive $172.5 million in cash and 24.5% ownership in the new company. Quaker Chemical will also take over Houghton’s debt and cash. At the end of 2016, Houghton’s debt stood at $690 million.

Michael F. Barry, Quaker Chemical’s president, CEO, and chairman, said, “We want to thank all our shareholders for their strong show of support; this vote recognizes the benefits the combined company will bring to customers, shareholders and associates.”

Quaker Chemical’s stock price movement last week

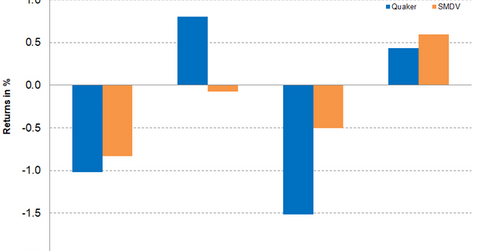

Quaker Chemical’s stock prices for the week ending September 8, 2017, fell 1.3% and closed at $138.60. Since the beginning of August 2017, Quaker Chemical has been trading below the 100-day moving average price. As of September 8, Quaker Chemical was trading 2.40% below the 100-day moving average price of $142.0. However, analysts expect Quaker Chemical’s stock price to be at $149.60 in the next 12 months, which implies a return potential of 7.90% from the closing price on September 8, 2017. Quaker Chemical has a 14-day relative strength index of 51, which indicates that the stock isn’t overbought or oversold.

Investors looking for indirect exposure to Quaker Chemical can invest in the ProShares Russell 2000 Dividend Growers ETF (SMDV). SMDV has invested 1.7% of its portfolio in Quaker Chemical. The fund also provides exposure to Avista (AVA), Atrion (ATRI), and Aaron (AAN) with weights of 2.10%, 2.10%, and 2.0%, respectively, as of September 8, 2017.