How Weyerhaeuser Treats Its Shareholders

REITs (real estate investment trusts) usually provide generous returns to their shareholders in the form of dividends or share buybacks.

Sept. 13 2017, Updated 9:06 a.m. ET

Why are dividends important for REITs?

REITs (real estate investment trusts) usually provide generous returns to their shareholders in the form of dividends or share buybacks, because REITs have to direct at least 90% of their profits toward shareholder returns.

This is a prerequisite for REITs like Weyerhaeuser (WY), Rayonier (RYN), Resolute Forests Products (RFP), and International Paper (IP) to perform as investment trusts, which helps them defer the corporate tax.

Dividend policy of Weyerhaeuser

Weyerhaeuser (WY) has always paid dividends regularly to its shareholders. It announced a regular quarterly cash dividend of $0.31 payable on September 22, 2017. Prior to this, the company paid a dividend of $0.31 per share on June 9, 2017. WY last hiked its quarterly dividend from $0.29 per share to $0.31 per share in June 2015.

Weyerhaeuser expects another dividend hike as there’s been an improvement in Southern Timberlands pricing, which has generated a growing earnings trend and provided a sustainable dividend source.

Dividend yield

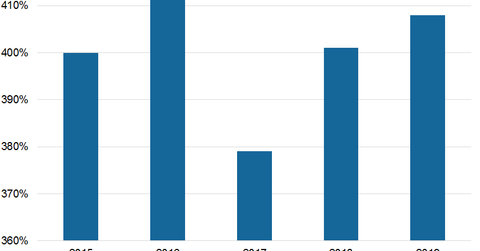

Weyerhaeuser offers attractive dividend yields to its shareholders. The company has offered a dividend yield of 3.73% over the past 12 months. It offered a dividend yield of 4.00% and 4.12% in fiscal 2015 and fiscal 2016, respectively. WY expects to offer a yield of 3.92% over the next 12 months and 3.78% for fiscal 2017.

Notably, the growing US economy has positively impacted REITs like Weyerhaeuser, Rayonier (RYN), Resolute Forests Products (RFP), and International Paper (IP). WY, RYN, and IP make up ~20% of the iShares Global Timber & Forestry ETF (WOOD), which has a yield of ~1.5%.