How Public Storage’s Dividend Yield Compares

Revenue and earnings Public Storage (PSA) an industrial REIT, invests in US and European real estate markets. Tthe company’s revenue grew 9% and 8% in 2015 and 2016, respectively. The growth was driven by self-storage facilities and ancillary operations. Its operating costs rose 2%–3% in 2015 and 2016, and its operating income rose 17% in 2015 […]

Sept. 18 2017, Published 11:21 a.m. ET

Revenue and earnings

Public Storage (PSA) an industrial REIT, invests in US and European real estate markets. Tthe company’s revenue grew 9% and 8% in 2015 and 2016, respectively. The growth was driven by self-storage facilities and ancillary operations.

Its operating costs rose 2%–3% in 2015 and 2016, and its operating income rose 17% in 2015 and 12% in 2016. Its gains on the sale of assets were lower in 2016. These rises and falls led to 16% growth in its 2015 EPS (earnings per share) and 12% growth in its 2016 EPS. Also, the company’s FFO (funds from operations) grew impressively.

Revenue and EPS in 1H17

Public Storage’s revenue and operating costs rose 5% in 1H17, its interest expenses rose 4%, and its operating income grew 6%, resulting in 7% EPS growth. Its FFO grew 5% in 1H17.

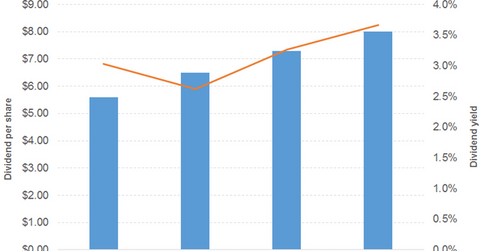

Dividend

The company has consistently increased its dividend. It maintained a fixed high payout ratio between 2014 and 2016, and the ratio increased further between 1H16 and 1H17.

Stock price

Public Storage stock was ahead of the PowerShares KBW Bank Portfolio ETF (KBWB) and the Shares Cohen & Steers REIT ETF (ICF) before their prices converged in 2017.

The WisdomTree Dynamic Currency Hedged International Equity ETF (DDWM) offers a dividend yield of 2.9%, at a PE (price-to-earnings) ratio of 17.3x. It has major exposure to Europe, and a 22%, 12%, and 2% exposure to financials, industrials, and real estate, respectively. The SPDR S&P Emerging Markets Dividend ETF (EDIV) offers a dividend yield of 3.8%, at a PE ratio of 11.1x. It has major exposure to Asia, and a 22%, 7%, and 4% exposure to financials, real estate, and industrials, respectively.