Behind Dollar General’s Fiscal 2Q17 Top Line

Dollar General (DG) saw its top line rise 8.1% YoY (year-over-year) to $5.6 billion, driven by an 8.9% rise in demand for consumables.

Sept. 5 2017, Updated 3:06 p.m. ET

DG beats on fiscal 2Q17 top line

Dollar General (DG), which reported its results for fiscal 2Q17 on August 31, saw its top line rise 8.1% YoY (year-over-year) to $5.6 billion, driven by an 8.9% rise in demand for consumables and a 6.5% rise in demand for seasonal products. The company outdid Wall Street expectations by $30 million.

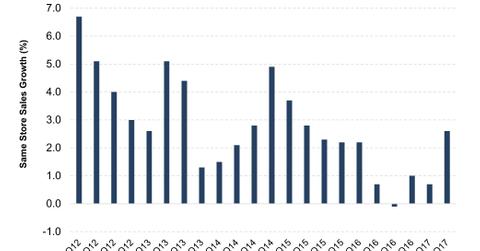

Same-store sales continue to improve

DG’s comps (comparable same-store sales) grew 2.6% in fiscal 2Q17, compared with its 0.7% growth in 2Q16. This growth in comps was driven by an increase in average transaction size as well as positive traffic trends. The current quarter was Dollar General’s best comps performance in the last year and a half. DG also witnessed growth in customer traffic, which had been negative for the past couple of quarters.

How have DG’s competitors fared?

Dollar Tree (DLTR) released its 2Q17 results on August 24, reporting a 5.7% YoY rise in its top line to $5.3 billion, beating the consensus by $45 million. DLTR’s comps rose 2.4% during the quarter.

Big-box retailer Wal-Mart Stores (WMT), which reported its 2Q17 results on August 17, also outdid Wall Street expectations. The company’s total sales rose $123.4 billion or by 2.1%, beating the expectation by $560 million. Walmart’s US comps rose 1.8% in 2Q17.

Investors looking for exposure to Dollar General through ETFs can consider the ProShares DJ Brookfield Global Infrastructure ETF (TOLZ), which invests 3.4% of its total holdings in DG.