A Look at Rite Aid’s Stock Crash This Year

Rite Aid’s shareholders have been the real losers from the delay and eventual termination of the deal between Rite Aid (RAD) and Walgreens Boots Alliance (WBA) in October 2015.

Sept. 20 2017, Updated 9:09 a.m. ET

Rite Aid stock fell 70.0% after initial WBA-RAD deal

Rite Aid’s shareholders have been the real losers from the delay and eventual termination of the initial acquisition agreement between Rite Aid (RAD) and Walgreens Boots Alliance (WBA) in October 2015. Rite Aid stock has fallen almost 70.0% since then.

The recent news of Rite Aid and Walgreens probably reaching a deal closure boosted Rite Aid stock on September 18, 2017, by 3.8%. The company is currently trading at $2.73, which is 220.0% below its 52-week high.

Rite Aid stock returns compared to its peers

Rite Aid has been the worst performing pharmacy retailer this year. It has fallen 68.0% YTD (year-to-date). In comparison, CVS Health (CVS) has risen 5.4%, and Walgreens has remained almost flat.

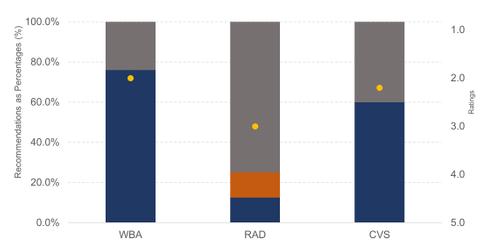

Wall Street recommendations for RAD

Rite Aid is covered by eight Wall Street analysts who have collectively given a 3.0 rating for RAD stock on a scale of 1.0 for “strong buy” to 5.0 for “sell.” Walgreens and CVS have better ratings of 2.0 and 2.2, respectively.

Six (or 75.0%) of the analysts have given a “hold” recommendation for Rite Aid, while one analyst each has suggested a “buy” and a “sell” for the stock.

Target price

Wall Street has assigned an average price target of $2.54 for Rite Aid, indicating a 7.0% downside over the next 12 months. The target price for the company ranges from $2 to $2.95.

Investors looking for exposure to Rite Aid through ETFs can choose to invest in the First Trust Consumer Staples AlphaDEX ETF (FXG), which invests 1.4% of its portfolio in the company.