Where Micron’s Profit Growth Stands next to Revenue Growth

Micron is thriving in a strong memory environment, wherein increasing DRAM (dynamic random access memory) and NAND prices are driving earnings.

Sept. 4 2017, Updated 10:36 a.m. ET

Micron’s profits

Micron Technology (MU) is thriving in a strong memory environment, wherein increasing DRAM (dynamic random access memory) and NAND prices are driving earnings. Apart from increasing ASP (average selling prices), Micron’s efforts to reduce costs and improve its product mix are increasing its profits faster than revenue.

Gross margin

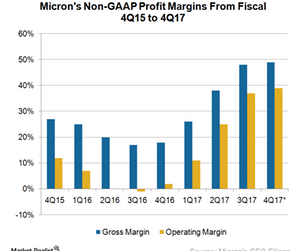

Micron’s non-GAAP (generally accepted accounting principle) gross margin rose from 38.5% in fiscal 2Q17 to 48% in fiscal 3Q17, reaching the high end of its guided range of 44%–48% and way above its fiscal 3Q16 gross margin of 18.1%.

Its gross margin improved as Micron’s shift to the 20 nm (nanometer) node reduced its DRAM production costs by over 20% and another transition to 1x node brought an even higher cost reduction. Similarly, the transition to 32-layer NAND (negative AND) reduced the production costs by sub-30%, and another transition to 62-layer reduced costs by another 30%.

For fiscal 4Q17, Micron expects to report a gross margin in the range of 47%–51% as it continues to ramp production of new technologies while continuing to produce older technologies to meet its diversified customer requirements. The company’s DRAM center of excellence in Taiwan (EWT) and its NAND center of excellence in Singapore (EWS) are working toward optimizing costs and improving speed and flexibility to meet customer needs.

Operating margin

On the operations front, Micron’s operating profits rose 43% sequentially to $2.07 billion, reaching an operating margin of 37%. Profits grew faster than revenues, which rose 19.6% sequentially, because operating expenses fell 2% sequentially to $600 million—well within its guided range of $560 million–$610 million.

Notably, Samsung’s (SSNLF) operating profit grew faster than its sales due to higher ASP and reduced costs.

Micron’s operating expense has a variable component referred to as a pre-qualification expense, which the company incurs to get its new products and technologies qualified by customers. The company’s operating expense could fluctuate, depending upon the qualification process.

For fiscal 4Q17, Micron expects its operating expenses to remain flat at ~$600 million, resulting in an operating margin of ~39% at the midpoint of the guidance.

EPS

Micron’s non-GAAP EPS (earnings per share) rose 80% sequentially to $1.62, beating the consensus estimate of $1.52 and its own guided range of $1.43–$1.57. For fiscal 4Q17, Micron expects to report EPS in the range of $1.73–$1.87.

Citi analyst Christopher Danely expects Micron to report EPS and revenues at the higher end of its guided ranges. Danely believes that Micron’s guidance is based on flat contract pricing, whereas, in reality, the contract pricing has increased in fiscal 4Q17.