EM Corporates Offer Huge Opportunities and Better Profile

VanEck A Diverse and Growing Category The emerging markets high yield bond market has grown tremendously over the past 10 years, from $56 billion at the end of 2007 to $440 billion as of June 30, 2017.[2. Source: BofA Merrill Lynch.] In addition to growing in size, diversity within the category has also increased. Investors currently […]

Aug. 21 2017, Updated 1:35 p.m. ET

VanEck

A Diverse and Growing Category

The emerging markets high yield bond market has grown tremendously over the past 10 years, from $56 billion at the end of 2007 to $440 billion as of June 30, 2017.[2. Source: BofA Merrill Lynch.] In addition to growing in size, diversity within the category has also increased. Investors currently gain exposure to 349 issuers in 48 different countries across the emerging markets. The quality and diversification help to explain why default rates in emerging markets corporates have been lower on average than in U.S. corporates.[3. Source: BofA Merrill Lynch. Based on the average annual default rates of The BofA Merrill Lynch Diversified High Yield US Emerging Markets Corporate Plus Index and The BofA Merrill Lynch U.S. High Yield Index, from 1999 to 2016.] And because the bonds are denominated in U.S. dollars, investors are not taking on additional currency risk in their portfolios.

Market Realist

EM corporate debt market surging higher

As the contribution of emerging economies to global GDP increased from 50% decade ago to almost 62% now, the corporate debt market in EMs has prospered, reporting a CAGR (compounded annual growth rate) of 30% since 2006. As measured by the MVIS EM Aggregate Bond Index, the current size of the EM corporate debt (EMB) (PCY) is close to $1.3 trillion or 41% of the total emerging markets bonds. EM corporate debt (CEMB) is rapidly closing the gap with the U.S. high yield (SJNK) market worth around $2.2 trillion. The EM corporate debt has now even surpassed the growth in its sovereign debt market.

Diverse issuances

The strong growth in EM corporate market is associated with a greater diversity. The rapid expansion in private sector is driving the corporate debt market in many emerging markets. Though financials still remain one of the largest sectors in terms of new debt, the market is witnessing higher issuances from other sectors as well including consumer driven corporates.

Lower default rates

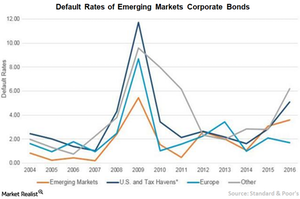

The default rates in EM corporates are lower than that of the US corporates (HYG), mainly due to better quality issuances and diversification. According to Standard & Poor, the default rate in EM debt was lower in 15 of the past 17 years. Moreover, in 10 of those 17 years, the default rate in EM corporate bonds was lower than both U.S. and European high yield bonds.

Lower currency risk

As shown in the chart above, dollar denominated corporate debt in EM grew rapidly, especially after 2011. This provides low-risk opportunities to investors seeking exposure to EM debt in US dollar denominated assets. As a hard currency asset class, which is usually in dollars, investors are not directly exposed to foreign exchange risk.

In short, in the current low yield environment, exposure to EM corporate bonds could potentially generate higher yield along with lower risks.