Albemarle’s 2Q17 Revenues Rose on Higher Volumes

ALB has guided its fiscal 2017 revenues to be in the range of ~$2.9 billion–$3.1 billion.

Aug. 10 2017, Updated 9:08 a.m. ET

Albemarle’s 2Q17 revenues

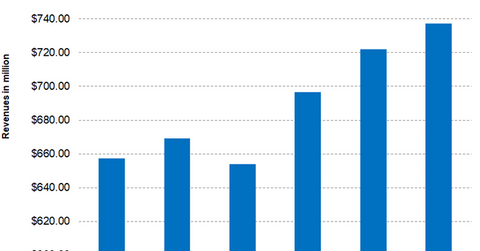

After market hours on August 7, 2017, Albemarle (ALB) reported its 2Q17 revenues of ~$737.3 million, an increase of 10.1% on a year-over-year basis. In 2Q16, ALB reported revenues of ~$669.3 million, beating the analyst estimate of $736.4 million.

These revenues are based on continuing operations, excluding the sale of the Chemetall Surface Treatment business to BASF for ~$3.2 billion.

Albemarle’s revenue growth was primarily driven by the continued growth in the Lithium and Advanced Materials segment, resulting in higher volumes. The price increases also helped ALB boost its revenues. The acquisition of Jiangxi Jiangli New Materials Science and Technology Co. Ltd. also boosted ALB’s revenues.

However, the divestiture of mineral-based flame retardants and its chemical business, along with its currency hedge strategies, had an adverse impact on ALB’s 2Q17 revenues.

Luke Kissam, ALB’s chairman and CEO, noted, “The Albemarle team delivered another quarter of year over year growth while meeting important milestones toward our long-term growth strategy. Total company adjusted EBITDA grew 15% and adjusted diluted EPS grew 22% over the second quarter of last year.

“This marks the sixth consecutive quarter of year over year revenue growth for the corporation. Our Lithium business continues to deliver strong year over year volume growth, and our major lithium capital expansion projects and exploration for new lithium resources remain on schedule.”

Outlook and guidance

Albemarle’s (ALB) Lithium and Advanced Materials segment is expected to contribute to ALB’s revenue growth for fiscal 2017 and beyond with its acquisitions and increased capacity. ALB has guided its fiscal 2017 revenues to be in the range of ~$2.9 billion–$3.1 billion.

Investors looking for broad-based exposure to ALB can consider the PowerShares DWA Basic Materials Momentum Portfolio ETF (PYZ), which invests 3.9% of its portfolio in ALB. PYZ also provides exposure to Chemours (CC), FMC (FMC), and LyondellBasell (LYB) with respective weights of 5.1%, 4.6%, and 3.5% on August 7, 2017.

In the next part, we’ll look at the 2Q17 performance of ALB’s Lithium and Advanced Materials segment.