Air Products & Chemicals’ Stock Price Rose

Air Products & Chemicals (APD) announced its fiscal 3Q17 earnings on August 1, 2017. Its adjusted EPS from continuing operations was $1.65.

Aug. 4 2017, Published 10:49 a.m. ET

Air Products & Chemicals’ fiscal 3Q17 earnings

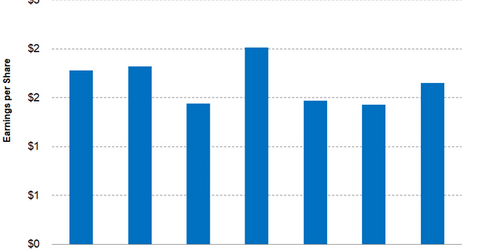

Air Products & Chemicals (APD) announced its fiscal 3Q17 earnings on August 1, 2017. The company reported adjusted EPS (earnings per share) from continuing operations at $1.65—an increase of 14.60% on a year-over-year basis. In fiscal 3Q16, its adjusted EPS was $1.44. Air Products & Chemicals also beat analysts’ estimate of $1.59 per share.

The adjusted EPS exclude impairment charges of $1.06 related to Latin America and AHG investment and $0.14 related to cost reduction and asset actions that include the sale of the hardgoods business.

The increase in Air Products & Chemicals’ earnings was primarily driven by the higher volume growth across all of its reporting segments. A reduction in interest expense and the tax rate also helped its earnings increase. Interest expenses fell to $29.8 million in fiscal 3Q17—compared to $35.1 million in fiscal 3Q16. The income tax provision for 3Q17 fell to $89.3 million—compared to $145.90 million in fiscal 3Q16.

On the other hand, foreign exchange translations and the increase in outstanding common shares had a negative impact on Air Products & Chemicals’ earnings.

Stock price reaction

Air Products & Chemicals stock reacted positively. The stock rose 4.8% and closed at $148.92. On the same day, Air Products & Chemicals’ peer Praxair (PX) rose 0.40%.

Revised guidance

Air Products & Chemicals increased the lower end of its adjusted EPS guidance for fiscal 2017 to $6.20–$6.25 compared to the earlier guidance of $6.00 to $6.25.

Investors can hold Air Products & Chemicals indirectly by investing in the Vanguard Materials ETF (VAW). VAW has invested 3.80% of its portfolio in Air Products & Chemicals. The fund’s other holdings include Dow Chemical (DOW) and DuPont (DD) with weights of 9.10% and 8.30%, respectively, as of August 1, 2017.

In this series, we’ll analyze Air Products & Chemicals’ earnings, revenues, reporting segment analysis, and analysts’ recommendations after its fiscal 3Q17 earnings.