Will American Tower Boost Its Shareholders’ Returns in 2Q17?

American Tower has paid dividends to its shareholders in every quarter since it became a public company. On June 1, AMT hiked its quarterly dividend by 3.2%.

July 20 2017, Updated 10:37 a.m. ET

Dividend payouts

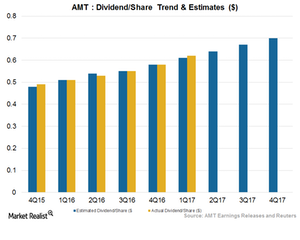

American Tower (AMT) has paid dividends to its shareholders in every quarter since it became a public company in 2011. On June 1, 2017, AMT hiked its quarterly dividend by 3.2% to $0.64 per share. This payment contributed to the company’s annualized dividend of $2.56, which it paid on July 14, 2017, to its shareholders of record as of June 15.

American Tower usually raises its dividend by an average of 23.7% each year. It’s consistently raised its dividend each year for the last five years. AMT hiked its dividend by 22% in 2016.

AMT’s recent dividend hike has raised the expected amount of its 2Q17 dividend. Analysts now expect the company to pay a dividend of $0.64 per share to its customers in 2Q17, compared to its dividend of $0.61 per share in 1Q17.

AMT had dividend yields of 1.8% and 2% in 2015 and 2016, respectively. It’s expected to maintain a dividend yield of 2% in 2017 as well.

AMT’s FFO (funds from operations) payout ratio was 39.2% in 1Q17. Analysts expect its FFO payout ratio to be higher during 2Q17 at 40.5%.

Repurchases could rise

American Tower’s share buybacks have been consistent and strong despite its higher stock price. In 1Q17, American Tower bought back shares totaling 1.9 million worth $225 million. The company started 2Q17 with a share buyback of ~1.7 million additional shares for $213 million.

Currently, American Tower has a next-12-month dividend yield of 1.9%, which is in line with the yields of its close competitors. Crown Castle International (CCI) has a dividend yield of 3.9%, Realty Income Corporation (O) has a dividend yield of 4.5%, and Simon Property Group (SPG) has a dividend yield of 4.8%.

The ProShares Ultra Real Estate ETF (URE) holds almost 17% in AMT and its peers. The ETF is diverse in terms of both geography and products, so it offers a cushion to investors.