What IBM’s Cash and Cash Flow Tell Us

In fiscal 2Q17, IBM’s cash reserves and marketable securities stood at ~$12.3 billion, and the company had ~$45.7 billion in debt.

Aug. 2 2017, Updated 10:35 a.m. ET

Cash, debt, and cash flows

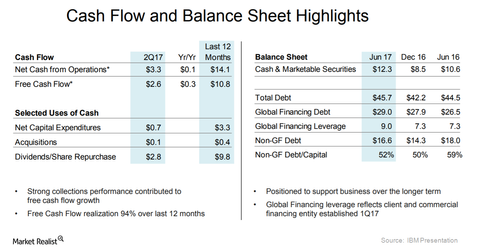

In fiscal 2Q17, International Business Machines’ (IBM) cash reserves and marketable securities stood at ~$12.3 billion, and the company had ~$45.7 billion in debt. In fiscal 2016, it had only $44 billion in debt. In fiscal 2Q17, IBM generated ~$3.3 billion and $2.6 billion in OCF (operating cash flow) and FCF (free cash flow), respectively.

In 2Q17, IBM returned $2.8 billion through dividends and share repurchases to its shareholders. Thus, IBM has returned more than what it has earned in cash flows to its shareholders. In June 2017, IBM had $2.4 billion remaining under its share repurchase authorization program.

Declining cash, mounting debt

Microsoft (MSFT), Apple (AAPL), and Cisco Systems (CSCO) are some of the technology players that have reported healthy growth in cash flows. But unlike its peers, IBM is trying to retain its investors and shareholders by offering huge dividend payments and share buybacks, which have resulted in the depletion of cash reserves and an increase in its debts.

IBM investors, of course, would like the company to generate FCF that can support the current dividend payment, at least, which IBM could gradually increase on a yearly basis, indulging in share buybacks enough to counterbalance new stock grants.

Share buybacks

Since 1997, when it had 1.9 billion shares outstanding, IBM’s shares outstanding have fallen to 932 million—less than half of what it had 20 years ago.

Remember, share buybacks are preferred as they reduce the number of shares outstanding, thereby increasing EPS. They hold special importance for the technology sector—particularly for IBM, which is finding it difficult to report top-line growth. Apart from the technology sector, the industrial, technology, and consumer sectors have also aggressively reduced their share counts.