What Do Analysts Expect from Nabors Industries’s 2Q16 Earnings?

In 2Q16, Wall Street analysts expect an adjusted loss per share of $0.45 for Nabors Industries (NBR). NBR will release its 2Q16 financial results on August 2.

July 19 2016, Published 11:21 a.m. ET

NBR’s 2Q16 earnings estimates

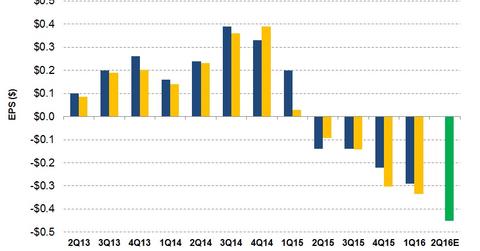

In 2Q16, Wall Street analysts expect an adjusted loss per share of $0.45 for Nabors Industries (NBR). This means that analysts expect NBR’s adjusted loss to deteriorate by 56% in the coming quarter from the 1Q16 adjusted loss of $0.29 per share.

Rigs idling or stacking and pricing concessions can result in a decline in NBR’s 2Q16 earnings. NBR will release its 2Q16 financial results on August 2.

From 1Q15 to 1Q16, Nabors Industries’s adjusted earnings turned negative primarily due to the falling rig count in the US. Before that, Nabors Industries had posted steady earnings growth from 2Q13 through 3Q14. During this period, its adjusted EPS increased ~3x.

Nabors Industries’s earnings versus estimates

In 1Q16, Nabors Industries’s adjusted EPS beat analysts’ consensus EPS. On an average, adjusted EPS exceeded the consensus EPS significantly in the past 12 quarters.

Analysts expect McDermott International’s (MDR) 2Q16 adjusted earnings to crash by 88% compared to its adjusted 1Q16 adjusted earnings. NBR comprises 0.15% of the ProShares Ultra MidCap400 ETF (MVV). MVV seeks a return that is 2x the return of the daily performance of the S&P MidCap 400 Index.

Next, we will discuss how much Nabors Industries’s revenue was affected by rig count changes.