The Story behind American Tower’s Strong Balance Sheet

In 2Q17, American Tower (AMT) topped its 2Q16 results on higher organic tenant billing and prudent cost controls.

Aug. 2 2017, Updated 7:36 a.m. ET

2Q17 performance

In 2Q17, American Tower (AMT) topped its 2Q16 results on higher organic tenant billing and prudent cost controls. The company carried on several expansion activities to maintain its leadership in the industry.

Notably, REITs (real estate investment trusts) like American Tower depend on equity and debt for their working capital, and so it’s very important for these companies to lever their balance sheets prudently.

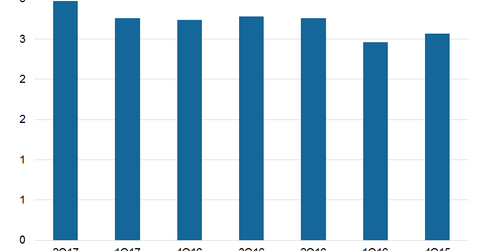

AMT’s DE (debt-to-equity) ratio stands at 2.97x for 2Q17—higher than the industrial mean of 1.07x. In 1Q17, AMT had a DE ratio of 2.76x.

Improving the balance sheet

American Tower ended 2Q17 with cash and cash equivalents of $0.8 billion. It also had a borrowing capacity of an aggregate of $2.7 billion under its revolving credit facilities.

In 2Q17, American Tower issued €500.0 million in euro-denominated notes and a $750-million principal amount of senior unsecured notes, carrying an interest of 1.4% and 3.6%, due in 2025 and 2027, respectively.

AMT used the proceeds to repay loans on one of its revolving credit facilities. The rest of the proceeds were used for general corporate purposes. These financing activities reduced its weighted average interest costs and provided it with longer terms for payments.

AMT’s close competitors include Realty Income Properties (O), SBA Communications (SBAC), and Crown Castle International (CCI). Realty Income has a debt-to-equity ratio of 0.86x, compared with Crown Castle’s 1.82x. AMT and its peers make up ~17% of the ProShares Ultra Real Estate ETF (URE).