Anworth Mortgage Paid 338.8% of Earnings in Dividends in 2016

Anworth Mortgage (ANH) paid 338.8% of its earnings as dividends in 2016 compared to 102.1% in 1Q17.

July 26 2017, Updated 2:06 p.m. ET

ANH’s dividend story

Anworth Mortgage Asset (ANH) paid 338.8% of its earnings as dividends in 2016 compared to 102.1% in 1Q17. The quarterly dividend payer has not changed its dividend rate per share since March 2015.

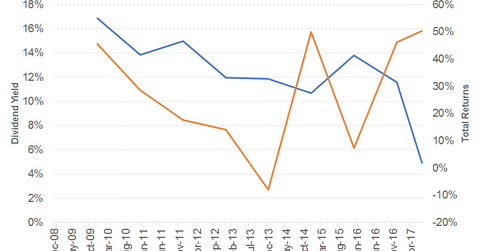

The diversified REIT has maintained an average yield of 13.2% and an average total return of 25.1% between 2009 and 2016. ANH has recorded a dividend yield of 4.9% and a total return of 50.4% on a year-to-date (or YTD) basis.

Fundamentals

ANH, like AGNC, also generates its income from its mortgage asset yield after deducting the borrowing costs.

ANH’s 2016 net interest income reported a decline of 31%, driven by lower contributions from agency MBS[1. mortgage-backed securities] and higher interest expense. Its 2016 EPS (earnings per share) recorded robust growth, driven by other income and a lower number of shares outstanding.

ANH’s 1Q17 net interest income fell 15% from 4Q16 and 23% from 1Q16 due to lower contribution from agency MBS and residential mortgage loans. Its 1Q17 EPS, which ended in positive territory unlike 1Q16, was flat compared to 4Q16. Other losses also weighed heavily on its 1Q16 EPS.

ANH has recorded negative growth in its FFO (funds from operations) in the last five years, with the exception of 2015. ANH’s financial leverage is even higher than AGNC’s financial leverage. ANH’s price-to-earnings multiple of 38.8x compares to a sector average of 84.4x. Its dividend yield of 9.8% compares to a sector average of 5%.