Honeywell’s Safety and Productivity Solutions: Why Revenue Rose

Honeywell’s (HON) Safety and Productivity Solutions segment is the smallest revenue contributor, accounting for 14.2% of HON’s total revenue.

July 26 2017, Updated 10:38 a.m. ET

Honeywell’s Safety and Productivity Solutions segment in 2Q17

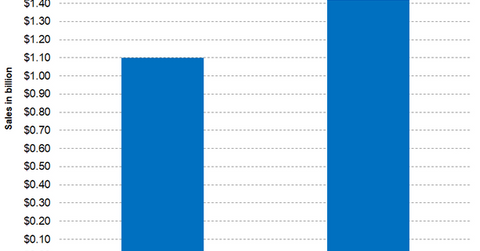

Honeywell International’s (HON) Safety and Productivity Solutions (or SPS) segment is a fairly new segment. It’s HON’s smallest revenue contributor, accounting for 14.2% of the company’s total revenue. In 2Q16, it accounted for 11.0% of total revenue. The segment reported revenue of $1.4 billion in 2Q17, a 30.0% rise on a year-over-year basis. In 2Q16, its reported revenue was $1.1 billion.

The segment’s revenue rose primarily due to the acquisition revenue from Intelligrated and improved volumes at Intelligrated. HON completed the Intelligrated acquisition in August 2016 for $1.5 billion. Intelligrated reported $900.0 million in revenue in fiscal 2016. The segment’s higher revenue was also supported by higher volume growth in its industrial safety products.

Net income and margin

Net income for SPS was $214.0 million, a 23.7% rise on a year-over-year basis. In 2Q16, the segment reported net income of $173.0 million. However, its margin fell due to increased cost of goods sold (or COGS). It reported COGS of $942.0 million, representing 65.9% of sales. In 2Q16, COGS stood at 64.2%. As a result, the segment reported a net income margin of 15.0% in 2Q17. In 2Q16, its net income margin was 15.7%, a decline of 70 basis points on a year-over-year basis.

Outlook for the segment

The SPS segment will continue to benefit from the Intelligrated acquisition. It expects volume growth to continue in the industrial safety business.

You can invest in the ProShares Ultra Industrials (UXI), which has invested 2.2% of its portfolio in HON. The top holdings of the fund include General Electric (GE), 3M (MMM), and Boeing (BA) with weights of 4.7%, 2.7%, and 2.5%, respectively, as of July 21, 2017.