Apple Hospitality REIT’s Dividend Trends

Apple Hospitality (APLE) has paid 157.9% of its earnings as dividends in 2016 compared to 200.0% in 1Q17.

July 26 2017, Published 12:10 p.m. ET

Apple Hospitality REIT’s dividend summary

Apple Hospitality (APLE) has paid 157.9% of its earnings as dividends in 2016 compared to 200.0% in 1Q17. The REIT’s IPO was in May 2015. The rate of dividend per share of the REIT has remained the same since 2015.

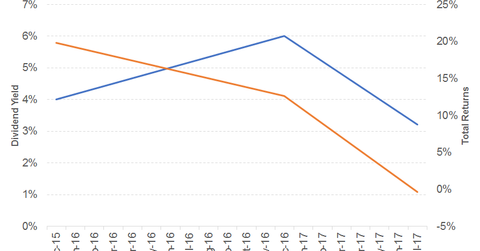

APLE recorded an average dividend yield of 5.0% and an average total return of 16.2% between May 2015 and May 2016 by the monthly dividend payer. It has recorded a dividend yield of 3.2% and a return of -0.3% on a YTD basis.

Fundamentals

Apple Hospitality (APLE) is the owner of one of the largest portfolios of upscale, select-service hotels in the US. It recorded a growth of 16% and 30% in its 2016 and 1Q17 (versus 1Q16) revenues, respectively, driven by higher room and other revenues. It has recorded growth of 4% in 1Q17 revenues compared to 4Q16.

APLE’s 2016 EPS recorded 17% growth, driven by higher operating income. Its 1Q17 EPS fell 21% and 25% compared to 4Q16 and 1Q16, respectively, due to higher interest expenses.

APLE has succeeded in recording growth in its FFO (funds from operations) in the last five years. In 2014, it witnessed its highest increase before it returned to its 2013 growth rate in 2016. It has the lowest financial leverage among its peers.

APLE’s price-to-earnings multiple of 24.6x compares to a sector average of 25.5x. A dividend yield of 6.4% compares to the sector average of 5.4%.

ETFs

The FlexShares Quality Dividend Index ETF (QDF) has exposure to real estate and has an annual dividend yield of 3%. The WisdomTree US Quality Dividend Growth ETF (DGRW), with no exposure to real estate, has an annual dividend yield of 2.8%.