This Segment Is Driving Carlyle’s Numbers

For 1Q17, Carlyle Group reported higher economic net income in its Corporate Private Equity segment, from $32 million in 1Q16 to $313 million in 1Q17.

May 23 2017, Updated 5:36 p.m. ET

Performance in 1Q17

For 1Q17, Carlyle Group (CG) reported higher ENI (economic net income) in its Corporate Private Equity segment, from $32 million in 1Q16 to $313 million in 1Q17, mainly due to appreciations. The company’s positive trend of higher deployments toward sectors such as defense, renewables, engineering, manufacturing, and services has resulted in improved numbers for alternative asset managers.

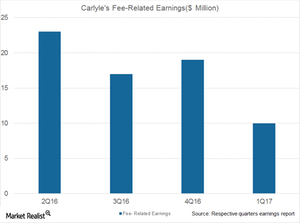

In 1Q17, Carlyle Group reported declining FRE (fee-related earnings) in its CPE (Corporate Private Equity) segment at $10 million in 1Q17, as compared to $32 million in 1Q16, due to a fall in the company’s fee revenues, which were around $23 million.

More than half of this decline was due to lower portfolio advisory fees, lower transactions, and lower balances, which relates to the company’s lower fee-paying AUM (assets under management) and led to lower management fees.

By comparison, KKR (KKR) reported rising FRE of $168.96 million in 1Q17, as compared to $132.3 million in 1Q16. Blackstone (BX) reported $182.5 million in 1Q17, as compared to $132.7 million in 1Q16.

Appreciations comforted net performance fees

Carlyle’s net performance income in 1Q17 stood at $313 million, which was higher than in 1Q16, which stood at $19 million. Its performance income in 1Q17 was mainly due to the appreciation of funds in its CPE segment of around 9% in 1Q17.

In 1Q17, Carlyle Asia Partners IV appreciated by 25%, while Carlyle Partners V appreciated by 21%, and Carlyle Partners VI appreciated by 7%. Carlyle Europe Technology Partners II appreciated by 34%. Its net performance fees had a positive impact on these funds in 1Q17.

Carlyle reported a fall in its fee-earning AUM for 1Q17, reporting $36.9 billion, as compared to $40.9 billion in 1Q16, mainly due to fewer activities being carried out in the company’s CPE segment.

More investments in CMC networks

The company’s primary focus in its CPE segment includes investments in buyout funds. The company’s buyout team advises to 20 active funds that are interested in making investments in particular geographies and industries.

One such investment was made by the company’s sub-Saharan fund in CMC networks, which has a global reach and transaction value exceeding $100 million and has Carlyle as a major shareholder. CMC is very positive about the research industry and believes that Africa’s demand will grow for high-quality bandwidth by 30%.

A blue-chip customer base

CMC has been targeting a blue-chip customer base. Since the above deal would likely make Carlyle a major shareholder—and since CMC’s revenue has quadrupled over the past five years—CG is expected to do well in this segment in coming quarters.

Notably, Blackstone (BX), Apollo Global Management (APO), and KKR (KKR) together make up 4.67% of the PowerShares Global Listed Private Equity ETF (PSP).