Sprint Remains Focused on Handset Leasing to Accelerate Growth

Sprint’s device leasing has helped it to regain its financial position. The take rates of Sprint’s leasing plans have continued to surpass its installment plans in the last few quarters.

May 29 2017, Updated 7:36 a.m. ET

Sprint’s leased devices

Sprint’s (S) device leasing has helped it to regain its financial position. The take rates of Sprint’s leasing plans have continued to surpass its installment plans in the last few quarters.

As a result, due to the financial benefits of leasing, Sprint’s lease revenues are expected to continue to rise going forward.

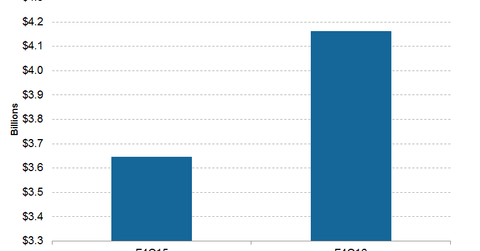

In fiscal 4Q16, the take rate of Sprint’s leasing plans reached ~42%. As we can see in the chart above, leased devices in the carrier’s property and plant and equipment businesses net it ~$4.2 billion at the end of fiscal 4Q16. During fiscal 4Q15, this figure was ~$3.6 billion.

Note that among the top four US wireless players, Sprint and T-Mobile (TMUS) offer leasing plans, and Verizon (VZ) and AT&T (T) don’t.

Sprint’s handset leasing benefits

During Sprint’s recent fiscal 4Q16 earnings conference call, its management said, “We are a leasing company and as you are aware we launched a program called iPhone Forever and in and out the different parts of the year we’ve launched a product called Galaxy Forever and therefore we are going to get several millions of phones back.”

Management continued, “What we do is we refurbish those devices and then we put them back in the market. We put some into our prepaid brand, we put some others in the auction market.”

As a result, Sprint anticipates generating ongoing additional revenue as it relates to used device sales.