How Wall Street Analysts View KKR’s Performance in 2017

Analysts gave KKR an average target price of $21.42 from the current price, suggesting a rise of 14.3%.

May 22 2017, Updated 10:36 a.m. ET

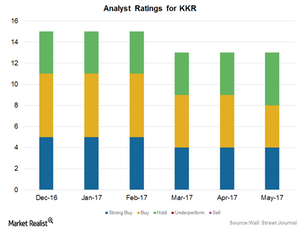

Stable rating allocation

KKR’s (KKR) performance in 2017 is positive according to analysts, as shown in their recommendations. Analysts gave KKR an average target price of $21.42 from the current price, suggesting a rise of 14.3%.

Out of 13 analysts who are currently analyzing the stock, four analysts recommended a “buy” rating, four analysts said the stock is “outperforming,” and five analysts recommended a “hold” rating.

Peer ratings

KKR’s major competitors include Blackstone Group (BX), Apollo Global Management (APO), and Carlyle Group (CG). Out of 14 analysts analyzing Blackstone Group stock, five analysts gave a “buy” rating, six analysts said that the stock is “outperforming,” and three analysts gave a “hold” rating.

Out of 15 analysts analyzing Apollo Global Management stock, seven analysts gave a “buy” rating, four analysts said the stock is “outperforming,” and four analysts gave a “hold” rating.

Out of 12 analysts analyzing Carlyle Group stock, three analysts gave a “buy” rating, three analysts said the stock is “outperforming,” and six analysts gave a “hold” rating.

Apollo Global Management (APO), Carlyle Group (CG), and Blackstone Group (BX) together comprise 4.1% of the PowerShares Global Listed Private Equity ETF (PSP).