HON’s Safety and Productivity Solutions Segment Rides High

HON’s SPS segment’s strong performance was primarily driven by the acquisition of Intelligrated.

April 26 2017, Updated 9:07 a.m. ET

Honeywell’s Safety and Productivity Solutions segment in 1Q17

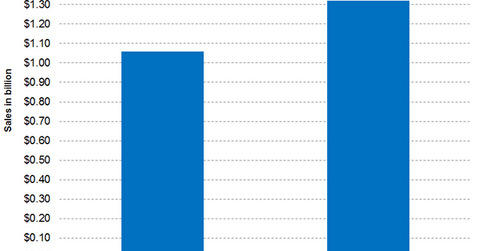

Honeywell’s (HON) Safety and Productivity Solutions (or SPS) segment is its second new segment along with HBT, as mentioned in the previous part of this series. The SPS segment is HON’s smallest revenue contributor. It accounted for a revenue share of 13.9% in 1Q17. The segment reported revenue of $1.3 billion in 1Q17, a 25% increase YoY (year-over-year).

HON’s SPS segment’s strong performance was primarily driven by the acquisition of Intelligrated. HON acquired Intelligrated for $1.5 billion, and the transaction was completed in August 2016. Plus, a volume increase in the industrial safety business boosted the segment’s revenues. On the other hand, the segment’s revenue saw adverse effects from its foreign currency hedging strategy.

Net income and margin

The SPS segment reported a net income of $194 million in 1Q17 as compared to $150 million in 1Q16, an increase of 29% on a year-over-year basis. The segment’s margin improved from 14.2% in 1Q16 to 14.7% in 1Q17, an increase of 50 basis points on a year-over-year basis.

Segment outlook

The SPS segment in 2Q17 is expected to continue its robust growth due to benefits from the Intelligrated acquisition. Plus, the productivity and the restructuring benefits are expected to continue to improve the segment’s net income and margins.

Investors can indirectly hold Honeywell by investing in the iShares Global Industrials ETF (EXI), which has invested 2.5% of its portfolio in Honeywell as of April 21, 2017. The top holdings of the fund include General Electric (GE), 3M (MMM), and Boeing (BA), which have weights of 6.6%, 2.9%, and 2.6%, respectively, as of April 24, 2017.

In the next part, we’ll analyze the performance of Honeywell’s Performance Materials and Technologies segment in 1Q17.