Off-Price Retailers Look to Outperform Department Stores in 2017

Despite a rough retail environment, off-price retailers TJX Companies (TJX), Ross Stores (ROST), and Burlington Stores (BURL) have been delivering strong sales growth. In this series, we’ll compare their margins, stock price movements, and analyst recommendations.

April 27 2017, Published 2:41 p.m. ET

Off-price retailer performance

Off-price retailers TJX Companies (TJX), Ross Stores (ROST), and Burlington Stores (BURL) delivered strong sales growth in their respective fiscal years, which was a tough period for many retailers. Fiscal 2016 ended on January 28, 2017, for BURL and ROST. Fiscal 2017 ended on January 28, 2017, for TJX.

Off-price retailers sell their merchandise at deep discounts compared with similar merchandise sold in department stores.

Sales growth rates

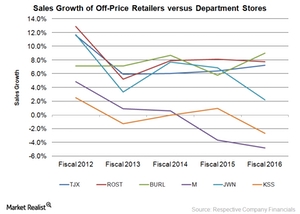

In fiscal 2017, TJX Companies generated top-line growth of 7.2%. In fiscal 2016, Ross Stores and Burlington Stores generated top-line growth of 7.8% and 9.0%, respectively.

In comparison, department stores Macy’s (M) and Kohl’s (KSS) disappointed with sales declines of 4.8% and 2.7%, respectively, in fiscal 2016.

Upscale department store chain Nordstrom (JWN), which also runs the off-price Nordstrom Rack stores, reported 2.2% growth in its fiscal 2016 revenues, including credit card revenues.

At the UBS Global Consumer Conference held on March 8, Macy’s chief financial officer, Karen Hoguet, pointed out that off-price retailers are a bigger threat than online retailers.

As more consumers look for bargain deals in off-price stores, department stores are looking to capture the growth opportunities in the off-price space. Aside from freestanding locations for its off-price Macy’s Backstage stores, Macy’s is also opening Backstage stores within Macy’s locations to drive more store traffic.

Store presence

TJX Companies is the largest off-price retailer in terms of retail sales and total stores. On January 28, 2017, TJX Companies operated 3,812 stores in the United States, Canada, the United Kingdom, Ireland, Germany, Poland, Austria, the Netherlands, and Australia.

Ross Stores operated 1,340 Ross Dress for Less stores and 193 dd’s Discounts stores at the end of fiscal 2016. Burlington Stores operated 591 stores at the end of fiscal 2016.

Series overview

In this series, we’ll compare off-price retailers’ margins, their stock price movements, and shareholder returns. We’ll also look at analyst recommendations for off-price retailers. The series will also compare the valuations of the major off-price retailers.