A Deep Dive into General Electric’s Pension Plan

After the financial crisis of 2008, many companies shifted toward defined contribution pension plans.

Dec. 8 2016, Updated 9:36 a.m. ET

Defined contribution plan

Under the defined contribution plan, the employer contributes a fixed amount to the fund on behalf of the employee. These funds can also match an employee’s own contributions into the retirement fund. The retirement funds received by the employee are related to the investment performance of the plan. The 401(k) is a common defined contribution plan. This plan structure ensures the employer’s autonomy in selecting the financial asset class—stocks, ETFs, or money market instruments.

The employer carries a substantially lower risk in this plan. Upon an employee’s retirement, the total available funds would depend on the employer’s contribution plus the employee’s savings, as well as the financial assets in which the money was invested.

Defined benefit plan

Under the defined benefit plan, a predetermined sum is guaranteed by the employer for an employee’s retirement. In order to fulfill this promise, the employer must make some specific assumptions such as the expected return on pension plan assets, compensation growth, tenure, and the discount rate for pension and other post-retirement obligations. The employer must watch the progress of the pension fund so the plan can succeed based on these assumptions.

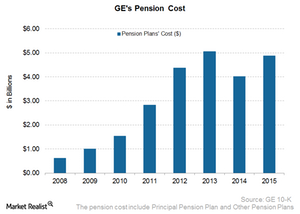

General Electric (GE) invests the funds collected in the defined benefit pension plan in various financial asset types. The difference between the pension obligation and the fair value of the plan’s assets denotes the overfunded or underfunded status of the pension plans.

If the defined benefit plan fails to perform in line with its assumptions, it can backfire on the employer. Unlike the defined contribution plan, the investment risk is undertaken by employer in a defined benefit plan. As a result, companies like General Electric (GE), Boeing (BA), Honeywell International (HON), and Lockheed Martin (LMT) would need to close the gap between plan obligations and the fair value of the plan’s assets.

After the financial crisis of 2008, many companies shifted toward defined contribution pension plans.