Will Muni Bonds Experience the January Effect in 2017?

The January Effect is a rise in asset prices often (but not always) observed throughout the month of January. There are a number of theories as to why this happens.

Jan. 20 2017, Published 10:27 a.m. ET

VanEck

Given the passing of 2016 and the advent of a new year, it’s time to take a closer look at an enduring, albeit inconsistent, market phenomenon, the “January Effect,” and what it may mean for municipal bonds in particular at the start of 2017.

What is the January Effect?

The January Effect is a rise in asset prices often (but not always) observed throughout the month of January. There are a number of theories as to why this happens. A leading hypothesis is that many investors, eager to offset capital gains taxes, engage in tax-loss harvesting at the end of the fiscal year. This can depress asset prices. At the start of the new year, these investors then re-establish positions in the market, pushing up asset prices once again.

The big question now is: Are muni bonds going to experience the January Effect this year? We think so given what we believe is a unique environment.

Market Realist

January Effect on muni bonds

We can see from the chart below that S&P Municipal Bonds have posted positive returns in January for most years. The same can be said for the full-year returns. In four instances, municipal bond returns diverged in January from the full year. However, similar upward trajectory has been maintained in six out of ten years. The January returns haven’t been able to predict the two years of decreasing full-year returns, one being the year of the subprime crisis.

Tax exemption of muni bonds

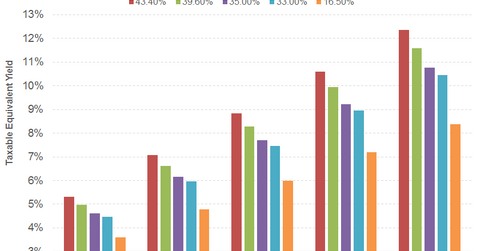

Municipal bonds are distinguished from other bonds and investments due to their tax exempted return status. Let’s look at a simple example. An investor has the option to invest $50,000 in a tax-free municipal bond yielding 6% or a taxable corporate bond yielding 8%. The investor falls in the 35% tax bracket. At first glance, it seems that the corporate bond is offering a greater return. Investment in the municipal bond will fetch the investor a tax-free income of $3,000, while the corporate bond will fetch an income of $2,600. Simply put, the corporate bond offers a return of 5.2%, which implies that a 6% tax-free municipal yield corresponds to a 9.2% taxable equivalent yield. The chart below depicts the yields as tax rates change.

Future events affecting muni bonds

If Donald Trump goes ahead with the cut in the marginal tax rate from 39.6% to 33% along with cutting the 3.8% Affordable Care Act tax, it might make investors more indifferent to their choice of bonds – municipal vs. others. Further, if Donald Trump also tampers with the tax-exempt status of the municipal bonds to make up for the losses he will be incurring by lowering tax rates, then that might lead investors away from municipal bonds.

Concerns remain about the further issuance of municipal bonds for Donald Trump’s $1 trillion plan to spend on infrastructure, which could also involve the doling out of tax credits worth $137 billion to private businesses to fund 82% of the equity needed for new projects. These tax credits would essentially act as a replacement for some municipal bonds, rendering them less necessary

The talk of three potential Fed rate hikes in 2017 also bodes poorly for municipal bonds, whose yields are inversely proportional to interest rates. The ProShares Investment Grade – Interest Rate Hedged ETF (IGHG) and the ProShares High Yield – Interest Rate Hedged ETF (HYHG) aim for a zero duration, thereby rendering them more insusceptible to interest rates changes.