In Focus: General Electric’s Pension Plan Assumptions

General Electric’s (GE) projected benefit obligation (or PBO) calculation takes into account the average years of service, the salary growth, and the discount rate.

Dec. 9 2016, Updated 8:05 a.m. ET

PBO assumptions

General Electric’s (GE) projected benefit obligation (or PBO) calculation takes into account the average years of service, the salary growth, and the discount rate. GE must discount its PBO with an appropriate discount rate to arrive at the current pension obligation on the balance sheet.

GE’s assumptions

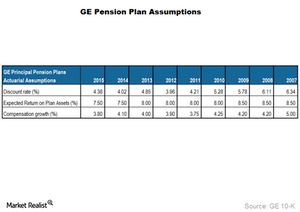

As you can see in the above chart, General Electric’s (GE) discount rate used for PBO has come down gradually. This decline has occurred since the Federal Reserve has hit hard on the high interest rate regime during the past few years. This resulted in the PBO’s ballooning value, which limits the pension plan assets and generates a liability on the balance sheet.

The discount rate assumption increased General Electric’s actuarial loss from $791.0 million in 2008 to $11.7 billion in 2014. However, GE recorded an actuarial gain of $4.0 billion in 2015, resulting from changes in its discount rate assumptions.

Is General Electric justified in its assumptions?

The expected return on a plan’s assets is the estimated long-term rate of return that will be earned on the investments used to fund the pension obligation. To arrive at the expected return on plan assets, General Electric (GE) considers the present and target composition of plan investments, its historical returns earned, and the company’s expectations about the future.

In our view, the assumption of a 7.5% rate of return seems to be a bit unrealistic. It was possible to achieve such a return when Treasury yields were 4% and not the current rate of 3.05%.[1. US 30-year Treasury yield] While the discount rate has dropped by 200 basis points since 2007, the expected return on investment has dropped by just 100 basis points. We believe this also needs a critical evaluation.

Even if we assume the fixed income to grow at the 30-year Treasury yield of 3%, the expected return on plan assets of 7.5% seems to be a bit stretched. According to a Forbes study, private equity in the US is expected to grow 10% in the long term.

Apart from General Electric, major players in the industrial space such as Boeing (BA), United Technologies (UTX), and Lockheed Martin (LMT) have more or less similar pension liability calculation assumptions.

Investors who prefer broad-based exposure to General Electric can opt for the iShares Global Industrials ETF (EXI). GE makes up 7.6% of EXI’s portfolio.