Bank of America Merrill Lynch Downgraded Delphi to ‘Underperform’

Delphi Automotive (DLPH) fell 1.9% to close at $65.23 per share during the second week of November 2016.

Nov. 20 2020, Updated 3:35 p.m. ET

Price movement

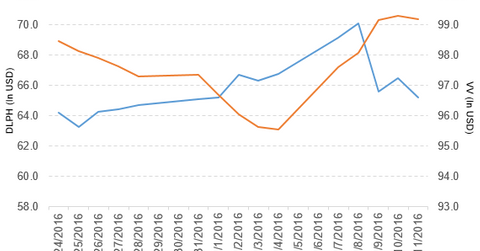

Delphi Automotive (DLPH) fell 1.9% to close at $65.23 per share during the second week of November 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -1.9%, -0.60%, and -22.5%, respectively, as of November 11.

DLPH is trading 0.24% below its 20-day moving average, 3.7% below its 50-day moving average, and 3.4% below its 200-day moving average.

Related ETF and peers

The Vanguard Large-Cap ETF (VV) invests 0.09% of its holdings in Delphi Automotive. The ETF tracks a market cap–weighted index that covers 85% of the market capitalization of the US equity market. The YTD price movement of VV was 7.7% on November 11.

The market caps of Delphi Automotive’s competitors are as follows:

DLPH’s rating

On November 9, 2016, Bank of America Merrill Lynch downgraded Delphi Automotive’s rating to an “underperform” from a “buy.”

Performance of Delphi Automotive in 3Q16

Delphi Automotive reported 3Q16 net sales of $4.1 billion, a rise of 13.9% compared to its net sales of $3.6 billion in 3Q15. Sales in its Electrical/Electronic Architecture, Powertrain Systems, and Electronics & Safety segments rose 17.8%, 1.2%, and 14.2%, respectively, in 3Q16 compared to 3Q15. The company’s operating margin narrowed 150 basis points in 3Q16 compared to the prior year’s period.

Its net income and EPS (earnings per share) fell to $293.0 million and $1.07, respectively, in 3Q16, compared to $404.0 million and $1.42, respectively, in 3Q15. It reported adjusted EPS of $1.50 in 3Q16, a rise of 17.2% compared to 3Q15.

Delphi’s cash and cash equivalents fell 26.2%, and its inventories rose 16.4% in 3Q16 compared to 4Q15. Its current ratio rose to 1.34x, and its debt-to-equity ratio fell to 3.1x in 3Q16, compared to its current and debt-to-equity ratios of 1.30x and 3.4x, respectively, in 4Q15.

During 3Q16, the company repurchased 1.5 million shares worth ~$100 million.

Projections

DLPH has made the following projections for 2016:

- revenue in the range of $16.4 billion–$16.5 billion

- adjusted operating income in the range of $2.16 billion–$2.19 billion

- adjusted EPS in the range of $6.00–$6.10

- cash flow from operations of $1.9 billion

- capital expenditure of $800 million

- adjusted effective tax rate of 17%

For an ongoing analysis of this sector, visit Market Realist’s Consumer Discretionary page.