Why Do Analysts Expect General Electric’s 3Q16 Revenues to Rise?

Analysts’ estimates Analysts estimate that General Electric’s 3Q16 revenues will total $30.0 billion, up by 7.3% on a year-over-year basis. Even though energy markets are acting as a deterrent to General Electric’s (GE) overall revenues, the favorable business environment in power, aviation, and healthcare will jack up the revenues. Analysts expect the next four quarters’ revenue to […]

Oct. 7 2016, Updated 4:25 p.m. ET

Analysts’ estimates

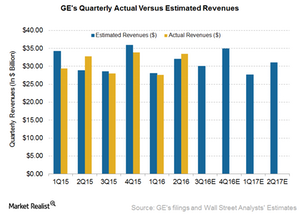

Analysts estimate that General Electric’s 3Q16 revenues will total $30.0 billion, up by 7.3% on a year-over-year basis. Even though energy markets are acting as a deterrent to General Electric’s (GE) overall revenues, the favorable business environment in power, aviation, and healthcare will jack up the revenues. Analysts expect the next four quarters’ revenue to reach $123.6 billion. In comparison, GE’s total revenues for the last four quarters totaled $122.8 billion. For fiscal 2016 and 2017, analysts expect GE to report revenues of $125.8 billion and $124.6 billion, respectively.

Along with GE Capital, GE has been moving away from its Appliances & Lighting business. In September 2016, GE Lighting announced its plans to exit Asia and Latin America. As part of its business portfolio restructuring, GE recently decided to move away from traditional lighting technologies and focus completely on LEDs (light-emitting diodes).

GE’s future revenue targets

General Electric targets organic growth of 2% to 4% in fiscal 2016. 1H16 revenues fell by 1% on a year-over-year basis. GE management hopes for a 5% rise in 2H16 and 2% in fiscal 2016. However, the organic fall of 18% in 1H16 revenues might wipe out revenue gains in the aviation and healthcare segments in the coming quarters.

GE Power is expected to dispatch 65% of its heavy-duty gas turbines over the next three to four months. With the acquisition of Alstom’s power assets, GE Power has become GE Industrial’s largest segment, accounting for 20%–25% revenues. GE Aviation is the second largest at 18%–20%, followed by GE Healthcare at 16%.

GE has been aggressively pursuing the industrial Internet space. With Predix, the industrial software platform, GE’s digital revenues are expected to grow 25%–30% through 2020 to reach $15.0 billion. To address industrial customers’ needs, GE has invested $1.0 billion in the Predix platform so far. The company estimates that the industrial Internet market’s potential could reach $225.0 billion by 2020.

ETF investment

Investors interested in GE could opt for the iShares Global Industrials ETF (EXI). GE makes up 7.4% of EXI’s portfolio. Other major industrial names in this ETF include 3M (MMM), Honeywell International (HON), United Technologies (UTX), Union Pacific (UNP), and United Parcel Service (UPS). In the next part, we’ll look at GE Aviation’s performance prior to the release of the 3Q16 results.