AMD Amazes with Comeback from Near Bankruptcy

As of September 30, 2016, AMD’s cash reserves stood at $1.3 billion as against long-term debt of $1.6 billion.

Nov. 3 2016, Updated 8:04 a.m. ET

AMD strengthens balance sheet

In the last few parts of the series, we saw that Advanced Micro Devices (AMD) is increasing its R&D (research and development) spending to develop a competing GPU (graphics processing unit) and CPU (central processing unit) product. To fund its product development efforts, the company reduced its debt and strengthened its balance sheet, which brought some financial flexibility.

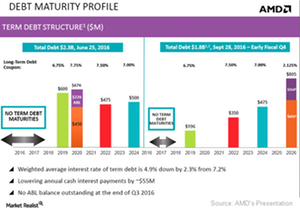

As of September 30, 2016, AMD’s cash reserves stood at $1.3 billion as against long-term debt of $1.6 billion. This was better than AMD’s June 30, 2016, cash reserves of $957 million and long-term debt of $2 billion. Let’s see how AMD strengthened its balance sheet.

AMD faced a cash crunch until fiscal 2Q16, as all the cash flows went into interest payments on its $2 billion debt. Even higher revenue and cost reduction could not convert into positive free cash flow because of the interest burden. In fiscal 3Q16, AMD reduced this interest burden by repaying debt and restructuring other debt.

Debt restructuring

In fiscal 3Q16 and 4Q16, AMD raised $1.4 billion in cash by issuing convertible notes and stocks and used $1.2 billion of this cash to repay debt. The company stated that it would use the remaining $162 million from the capital proceeds for capital expenditures, working capital, and general purposes.

Raising capital

While restructuring debt, AMD aimed at repaying the most expensive debt first and then reducing the amount of other expensive debt. In this plan, the first step was to raise money. In fiscal 3Q16, it issued $700 million in 2.1% convertible notes due in 2026 and $600 million in stock that had an underwriter’s option to buy additional stock worth $90 million. In fiscal 4Q16, the company issued another $105 million of convertible notes due in 2026.

Repaying debt

AMD used the cash raised to repay its most expensive debt of $676 million due in 2020, which carried an interest of 7.8%. Then the company used the funds to reduce the $600 million in debt due in 2019 to $196 million. Then it spent another $150 million to reduce the debts due in 2022 and 2024.

With this, it reduced its weighted average interest rate of term debt from 7.2% to 4.9%, which will reduce AMD’s $160 million annual interest expense by $55 million, starting in fiscal 4Q16.

AMD is not the only company that restructured its debt. Even NXP Semiconductors (NXPI) restructured its debt to reduce interest burden. Next, we’ll see how this debt restructuring could impact AMD’s other balance sheet items.