Will Global Overcapacity Weigh Heavy on Steel Prices?

The excess global steel capacity will take a lot of time to balance out. The capacity closures in China, if they happen at all, will be gradual.

March 15 2016, Updated 10:05 p.m. ET

Global overcapacity

The excess global steel capacity will take a lot of time to balance out. The capacity closures in China, if they happen at all, will be gradual. Moreover, the capacity cuts might not help in reducing the country’s overcapacity, as China’s steel demand itself is falling. The China Iron & Steel Association expects Chinese steel demand to fall by 100 million metric tons by 2030. So, basically, even if China cuts its steel capacity in small doses, on an absolute basis, the country’s overcapacity will stay largely unchanged.

Steel could be lower for longer

Steel prices could continue to be lower for a much longer period than other industrial metals. Steel’s problem is actually twofold: falling demand and resilient supply. It will be a long and painful adjustment period before demand and supply balance out. Capacities would have to be permanently closed in China and elsewhere over the next few years for some sanctity to return in global steel markets. But, it’s not an overnight activity. It will take years for the markets to return to balance.

Trade cases

The US has recently slapped strict anti-dumping duties on several Chinese steel products acting on complaints from steelmakers like U.S. Steel (X), AK Steel (AKS), Steel Dynamics (STLD), and ArcelorMittal (MT). However, trade cases in the developed economies might trigger a reaction from China as it tries to save its steel producers. China already seems to be taking an aggressive stance by threatening to go to the WTO as more countries impose anti-dumping on Chinese steel products. China has already stated that overcapacity is a global problem and is not specific to China.

It’s all about China

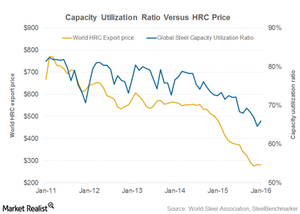

Steel overcapacity is here to stay for a pretty long time. In the meantime, steel prices could continue to trade lower. Capacity utilization ratio is a key driver of steel prices. The graph above shows world export spot hot-roll coil (or HRC) prices plotted against the capacity utilization ratio. As you can see, steel prices have been moving in tandem with the capacity utilization ratio.

But as said earlier, we might have reached a bottom in steel prices, and big bouncebacks in steel prices might not happen. However, if the rally in China delivers on its capacity curtailment announcement and cuts its excess steel capacity substantially and immediately, we could see some sanity return to global steel markets.

In the next part, we’ll do a comparative analysis of the three metals that we’ve covered in this series.

You can also consider the Materials Select Sector SPDR ETF (XLB) to get diversified exposure to the materials sector. Metal producers currently form ~9% of XLB’s portfolio.