Charles Schwab Trading at Multiyear Low Valuations

Charles Schwab’s valuations declined significantly over the past month mainly due to macro factors such as China’s slowing economy and a weaker domestic economy.

Sept. 18 2015, Updated 8:05 a.m. ET

Equity returns

Charles Schwab’s (SCHW) stock has returned 3% over the past 12 months and is trading at 20% below its 52-week high. The company is focusing on services and technology to add new clients and assets. Despite the decrease in daily trades during 2Q15, it managed to beat the analyst estimates and posted strong growth in client assets.

The company declared a dividend of $0.06 per share, translating into an annualized yield of 1.2%. Its peers in the brokerage industry have the following dividend yields:

- Interactive Brokers (IBKR) has a 1.06% dividend yield.

- TD Ameritrade Holding (AMTD) has a 1.58% dividend yield.

- E*TRADE (ETFC) doesn’t pay dividends.

Together, these companies form 10.80% of the iShares U.S. Broker-Dealers ETF (IAI). Charles Schwab is expecting to maintain 20–30% payout of earnings in the upcoming quarters.

Macro factors leading to lower valuations

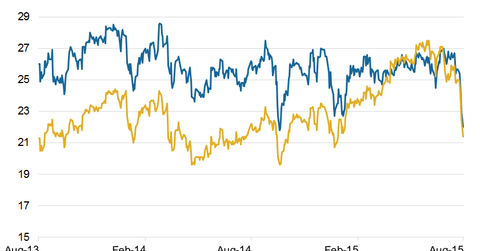

Currently, Charles Schwab is trading at 22x on a one-year forward earnings basis. Its peers in the brokerage industry are trading at a 21.4x average. Historically, the company has traded at a premium to its peers because of its strong brand, large client base, and diversified assets. Its valuation declined significantly over the past month mainly due to macro factors such as China’s slowing economy and a weaker domestic economy. Charles Schwab has traded in a range of 21x–29x on a one-year forward earnings basis. The company will likely benefit from an increase in volatility on account of fluctuating oil, commodities, and exchange rates.

The trading activity in the US equity market is expected to be lower in the next few quarters as economic growth consolidates. However, Charles Schwab is focusing more on increasing client assets through advisory-based products, innovative ways of providing wealth management and retirement services, and deployment of technology for retail as well as institutional clients. The increase in volatility on account of global factors or a delayed hike in interest rates will likely positively impact the company’s trading revenues. Charles Schwab is expected to benefit due to its strong brand, innovative solutions, and banking products.