Oracle’s Database Cost Is Its Best Defense in Open Source Space

Except for Oracle’s relational databases, all other databases—especially MySQL—are losing to NoSQL databases.

Nov. 20 2020, Updated 1:21 p.m. ET

Client stickiness for Oracle database is high

In the previous article, we saw that the increasing adoption of open-source databases is causing a dent in Oracle’s (ORCL) dominance in the database market, as well as its earnings. On June 17, 2015, Oracle announced its fiscal 4Q15 and 2015 results. Software licensing and support contribute approximately half of Oracle’s overall revenues.

We also discussed how the growing preference for open-source databases is a source of concern for Oracle, which has a dominant presence in this space. Cost is an important factor for startups and other decision-makers in choosing a database.

Oracle versus open source

According to Matt Pfeil, co-founder of software firm DataStax, a customer who paid ~$500,000 in Oracle software licenses switched over to DataStax and now spends ~$90,000 for a comparable project. Instances such as this show that cost plays a major role in this industry.

However, one key factor to note is that enterprises take care when considering a change in their chosen databases. Once data goes into a particular database, chief information officers try their level best to keep it there. Their dependence on the database, coupled with the associated costs in shifting to another database, is a significant risk that often outweighs the benefits of choosing open-source software.

For instance, when open-source database MySQL was first released, it was a hit because it easily handled huge workloads that required scale. However, as technology improved rapidly, alternatives such as MongoDB entered the mix.

Crossing the streams

Companies find it easier to replace one open-source database with another, rather than leave Oracle or SQL Server, which come with a substantial price tag and client stickiness. However, it appears that the significant cost of Oracle’s products is its greatest defense.

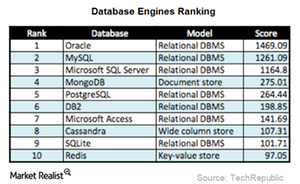

As the above chart shows, except for Oracle’s relational databases, all other databases—especially MySQL—are losing to NoSQL databases. NoSQL incorporates different database technologies, implemented in response to the SMAC revolution (or social, mobile, analytics, and cloud), and it caters to the huge volume of data stored and accessed. It also addresses related performance and processing requirements.

On the other hand, relational databases are not designed to cope with the scale and agility challenges presented by Big Data. Please read Why traditional database systems fail to support “big data” for more detail.

Oracle still has loyal client base

Despite the insurgent open-source database providers, Oracle’s database still commands considerable loyalty. NetSuite (N) CEO Zach Nelson describes Oracle’s software as “the best transaction database.” He added, “It only costs us 6 percent of revenue, and that’s nothing.” Realizing the growing popularity of cloud computing, Oracle launched Database 12c in 2013—the “c” refers to its cloud capabilities. According to Oracle’s July 2013 release, “Oracle Database 12c introduces a new multitenant architecture that simplifies the process of consolidating databases onto the cloud; enabling customers to manage many databases as one—without changing their applications.”

Salesforce.com (CRM) and SAP (SAP) partnered with Oracle in order to deploy their applications on Oracle’s Database 12c. Please refer to Must-read: Will Oracle’s 12c database attract investors? for more information.

Oracle enjoys a high customer stickiness. However, with its substantial licensing price tag plus its Database 12c offering, it remains to be seen how the company will deal with the rising threat posed by DataStax and other open-source databases.

To gain diversified exposure to Oracle, you can invest in the PowerShares QQQ Trust ETF (QQQ) and the Technology Select Sector SPDR Fund (XLK). QQQ and XLK invest about 3.08% and 3.41% of their holdings in Oracle, respectively.