Is Jet.com a Potential Threat to Amazon’s Business?

Amazon (AMZN) has a new competitor in town—Jet.com. It opened to the public early last week. The startup was founded by Marc Lore.

Jul. 29 2015, Published 1:07 p.m. ET

Jet.com promises the lowest prices online

Amazon (AMZN) has a new competitor in town—Jet.com. It opened to the public early last week. The startup was founded by Marc Lore. He challenged Amazon in the past with his venture, Quidsi.

Quidsi was the parent marketplace of sites like Diapers.com and Soap.com. It grew to $300 million in annual sales of diapers and other similar items in 2010. Quidsi got Amazon’s attention. Amazon slashed diaper prices by one-third. This forced Lore to sell the venture to Amazon.

Lore earned $550 million from selling Quidsi. Now, he’s back in the market with a unique platform. Jet.com claims to offer the cheapest prices for Internet shopping.

The startup promises to offer prices that are 10%–15% cheaper than anywhere else on the Internet. Also, customers can save on the shipping costs when they add more items to their cart. Savings will depend on the nature of items shipped from the same warehouse and on the distance between the customer and the merchandise.

Besides the above, customers could save more by choosing options like making payments with debit cards or being willing to wait for items to be shipped in the same package.

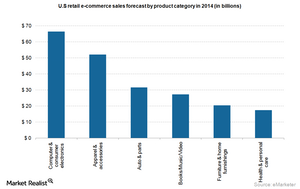

According to a report from eMarketer, and as the above chart shows, electronics, apparel, furniture, and healthcare are the four largest categories in the US retail e-commerce market. These are the four categories where Amazon’s prices were higher than Walmart and Target, according to a report from the Wall Street Journal.

Walmart and Target’s online prices are cheaper than Amazon

This isn’t the first time that Amazon has been compared with other retailers. According to a report from the Wall Street Journal that cites research firm 360pi, which tracks online products prices, Walmart (WMT) and Target’s (TGT) online prices could be 5%–10% cheaper on average than Amazon’s prices. The report also says that Amazon’s prices were cheaper than online prices at Kohl’s, Sears, and Macy’s (M).

You can get exposure to Amazon by investing in the Consumer Discretionary Select Sector SPDR Fund (XLY). It has 6.10% exposure to the company.