If You Want to Pay Less for Netflix, You're Going to Have to Deal With Ads

Netflix is officially offering a plan with ads after months of speculation. Here is everything you need to know about the streaming platform's "Basic with Ads" plan.

Oct. 14 2022, Updated 10:53 a.m. ET

After months of speculation, it is finally happening.

Starting in November, Netflix will be offering a "Basic with Ads" plan to lower the price of its monthly subscription.

"In short, 'Basic with Ads' is everything people love about Netflix, at a lower price, with a few ads in-between," the company's COO/CPO Greg Peters said in the statement.

So, what does this mean for loyal Netflix subscribers? And what changes can you expect with the new plan? Keep reading to find out.

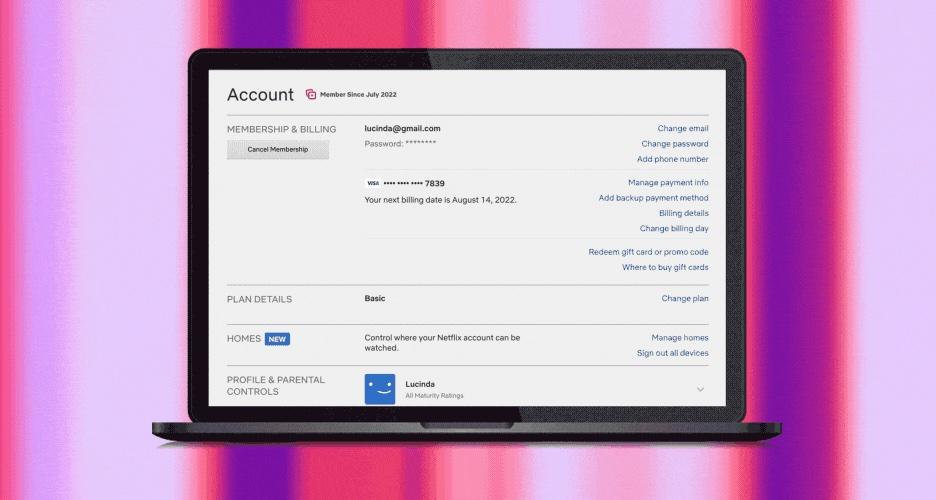

Netflix's "Basic with Ads" plan will cost $6.99 a month — three dollars less than its "Basic" plan.

Starting Nov. 3, Netflix subscribers in the United States will be able to opt for Netflix’s lower-priced ad-supported plan for $6.99. Currently, Netflix's Basic plan starts at $9.99, and the Premium subscription costs $19.99.

The "Basic with Ads" plan will also be available in Australia, Brazil, Canada, France, Germany, Italy, Japan, Korea, Mexico, Spain, and the U.K.

"Basic with Ads also represents an exciting opportunity for advertisers — the chance to reach a diverse audience, including younger viewers who increasingly don’t watch linear TV, in a premium environment with a seamless, high-resolution ads experience," Netflix shared in a press release.

Subscribers can expect 4–5 minutes of ads per hour.

There will be some differences in Netflix's "Basic with Ads" plan.

While the ad-supported plan will still offer access to Netflix's extensive streaming library, there will be a limited number of movies and TV shows that won't be available due to licensing restrictions.

Also, subscribers won't be able to download any titles and will receive video quality up to 720p/HD.

So, how will the ads work on Netflix?

According to the company, the ads, which will be between 15–30 seconds each, will run before and during shows and films.

This is similar to Hulu's current ad-supported plan, which is currently available for $7.99. As expected, Netflix users weren't too excited about the new plan.

"Netflix with ads $6.99... Hulu with ads 7.99... So basically we are slowly going back to cable TV," one person tweeted before another added, "Netflix trying to get people to come back by introducing ads and a cheaper price point rather than addressing the fact that its content offering is inferior to other platforms."

A third sarcastically chimed in, "Can't wait to pay $6.99 for Netflix streaming at 720p with ads that are probably 4K."

Next, Netflix is going to end password sharing.

At the beginning of 2022, Netflix announced price hikes for all its plans, and by July 2022 the company reported a loss of over one million subscribers during the company's earnings call.

However, despite the drop in subscribers, Netflix's revenue was still up 9 percent from the previous year due to the increased average revenue per membership.

Netflix also detailed plans to monetize the 100 million+ households that are "currently enjoying, but not directly paying for, Netflix."

That's right, Netflix's next plan is to crack down on password sharing in 2023.

"Our goal is to find an easy-to-use paid sharing offering that we believe works for our members and our business that we can roll out in 2023," the company explained earlier this year.

Netflix has already started testing out this plan by asking subscribers in Argentina, the Dominican Republic, El Salvador, Guatemala, and Honduras to pay more if they want to stream to more than one home.

"We’re encouraged by our early learnings and ability to convert consumers to paid sharing in Latin America," Netflix added.

You know what they say, the good times never last forever.