TRW Automotive Holdings Corp

Latest TRW Automotive Holdings Corp News and Updates

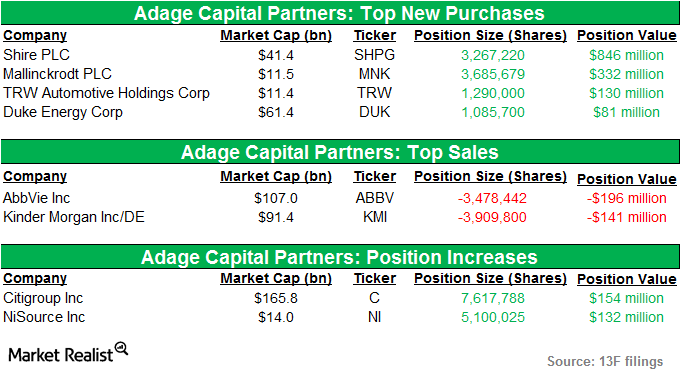

Adage Capital adds a new position in Mallinckrodt

Adage Capital added a new position in Mallinckrodt Plc (MNK) in the third quarter of 2014. The position accounted for 0.82% of the fund’s total portfolio.

A key overview of Adage Capital’s holdings in 3Q14

Adage Capital’s US long portfolio grew from $38.69 billion in 2Q14 to $40.2 billion in 3Q14. The portfolio comprised around 699 stocks.