T. Rowe Price Africa & Middle East

Latest T. Rowe Price Africa & Middle East News and Updates

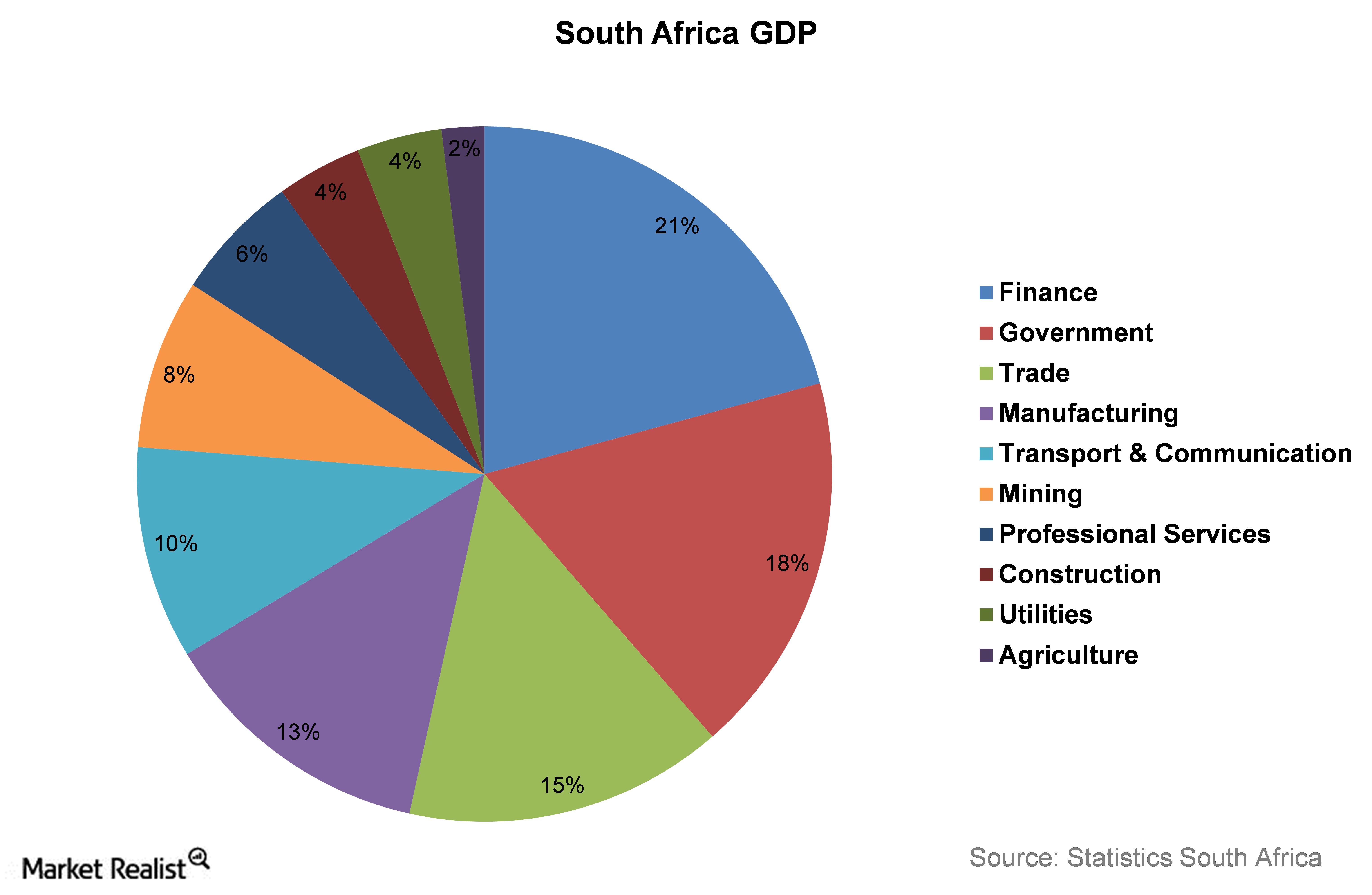

An Overview of the South African Economy’s Structure

The finance sector here consists of finance, real estate, and business services. The South African economy depends heavily on the manufacturing sector.

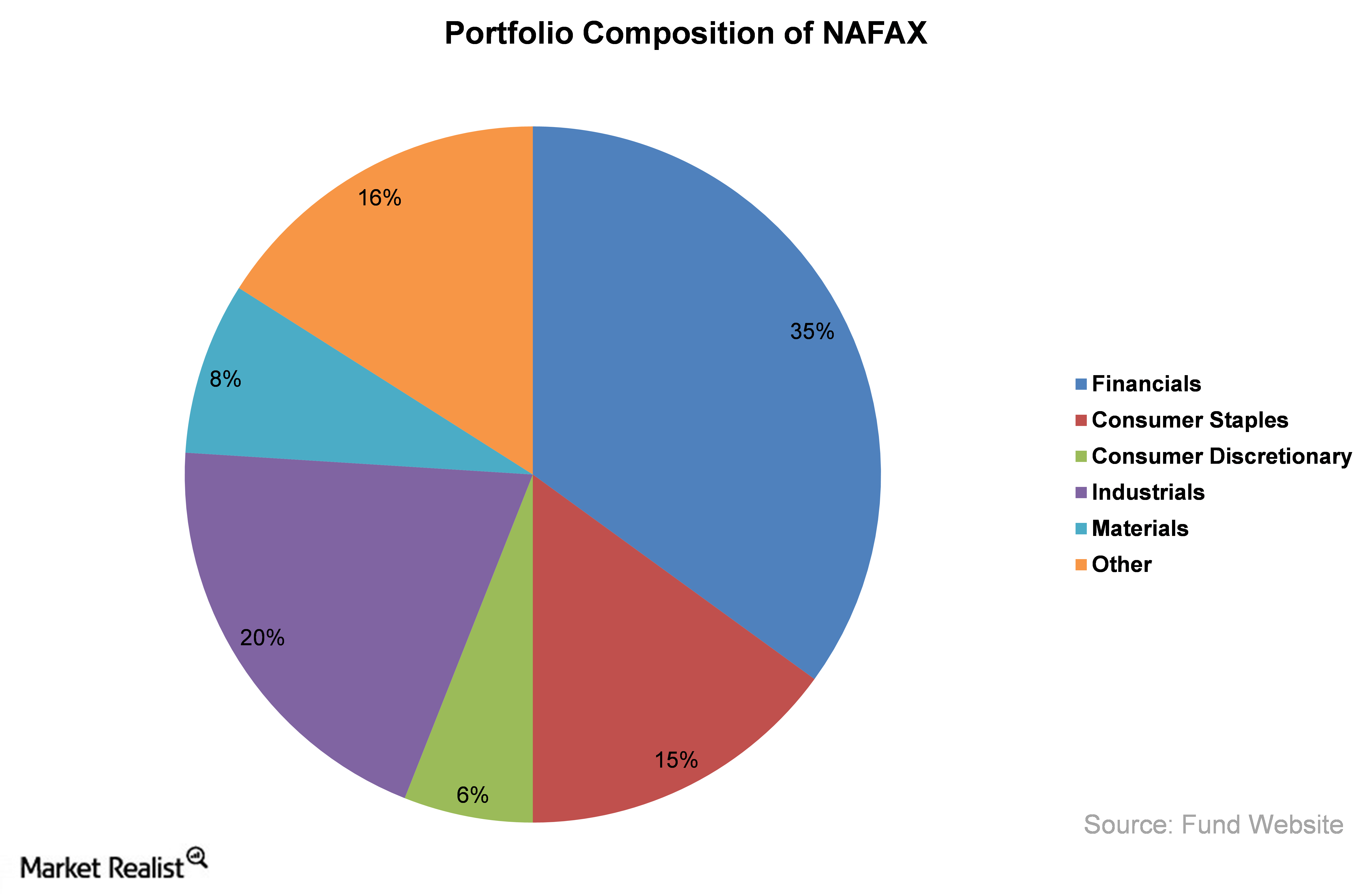

The Nile Pan Africa A Fund: Negative Returns for 5 Years

The Nile Pan Africa A Fund (NAFAX) invests at least 80% of its portfolio in the stocks of Africa-based companies. The majority of the fund’s exposure is in South Africa.