Prudential PLC

Latest Prudential PLC News and Updates

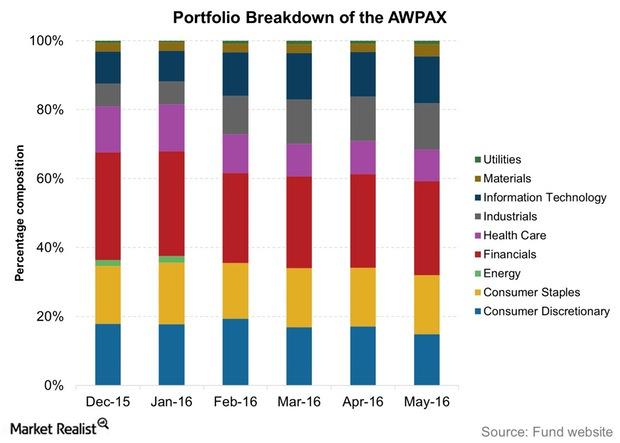

Portfolio Moves of the AB International Growth Fund in YTD 2016

The AB International Growth Fund’s assets were spread across 57 holdings in May 2016, and it was managing $334.2 million in assets.Company & Industry Overviews AEPGX’s Low Volatility and Low Returns: What Does This Mean?

The American Funds EuroPacific Growth Fund (AEPGX) has been in existence since April 1984.