ORANGE

Latest ORANGE News and Updates

Understanding Vodafone’s Cost Structure and Earnings Margins

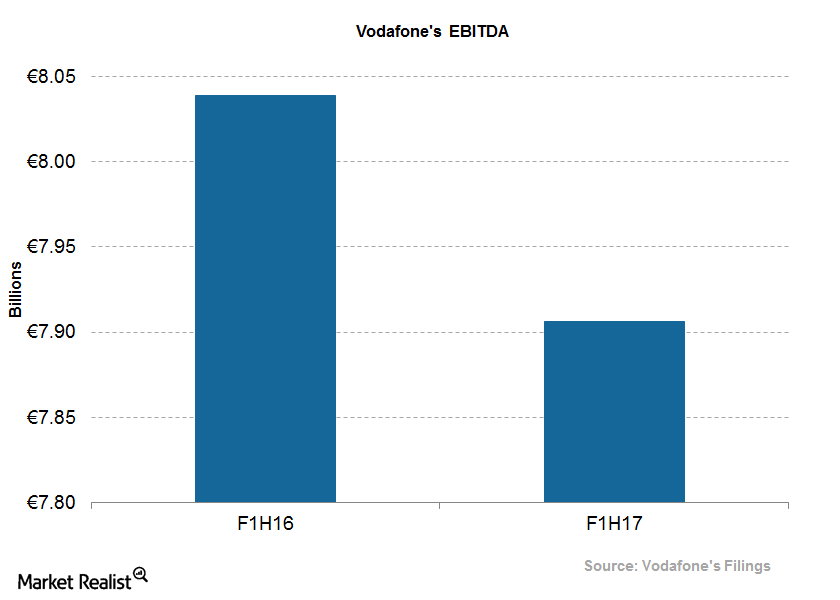

Vodafone’s EBITDA was ~7.9 billion euros in fiscal 1H17, compared to ~8 billion euros in fiscal 1H16. Its EBITDA margin rose to 29.2% in fiscal 1H17.

Analyzing the European Union’s GDP Composition

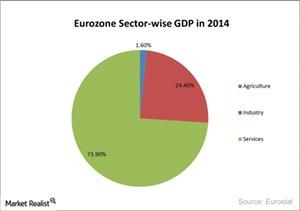

The EU’s (European Union) GDP (gross domestic product) depends on the service sector. The service sector contributes ~73.90% towards the EU’s (EZU) GDP.