Nile Pan Africa A

Latest Nile Pan Africa A News and Updates

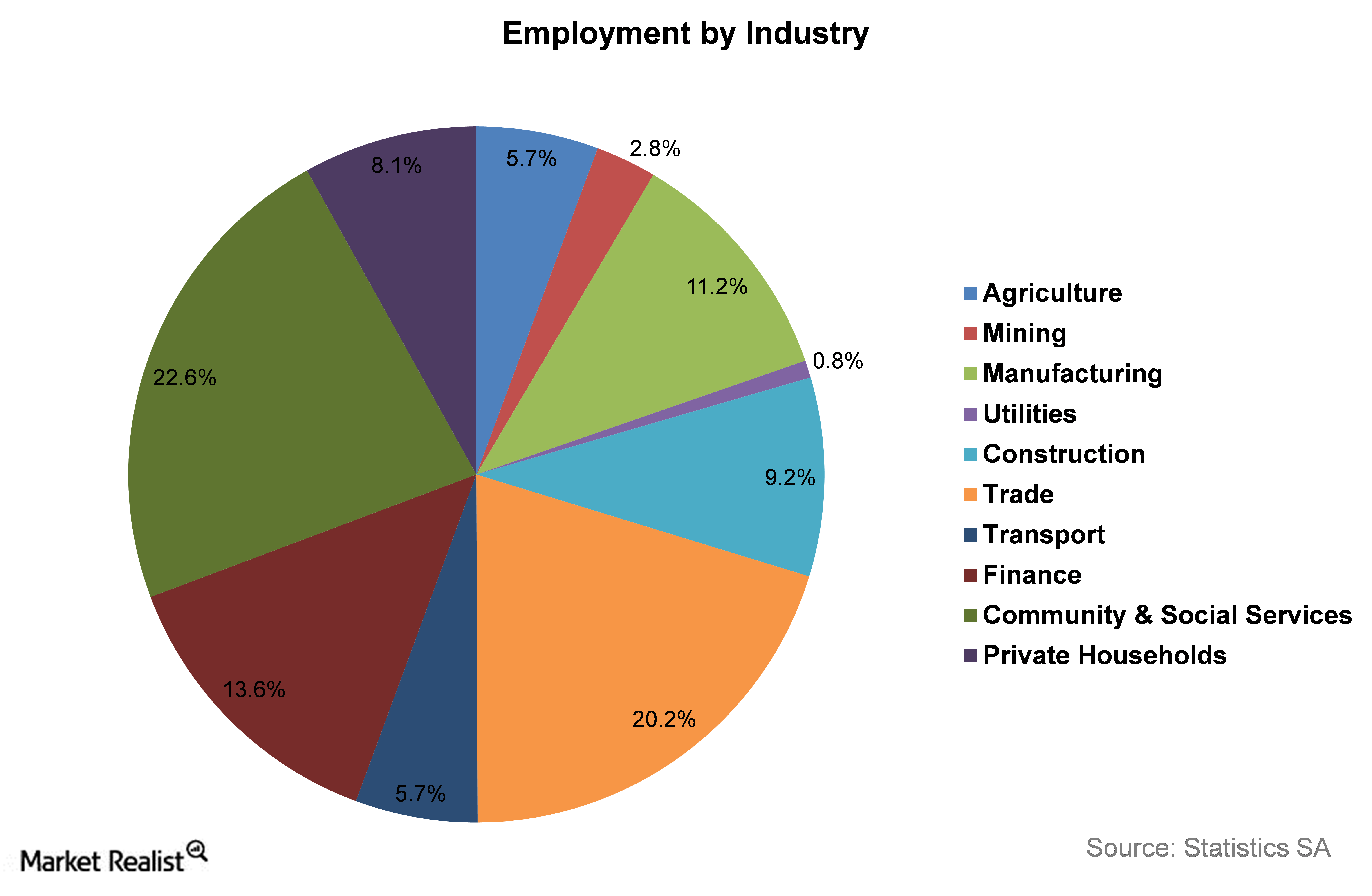

Unemployment Remains a Major Concern for South Africa

South Africa’s unemployment rate was as high as 25% in 2015. The high unemployment rate has been a serious issue in the country for several years now.

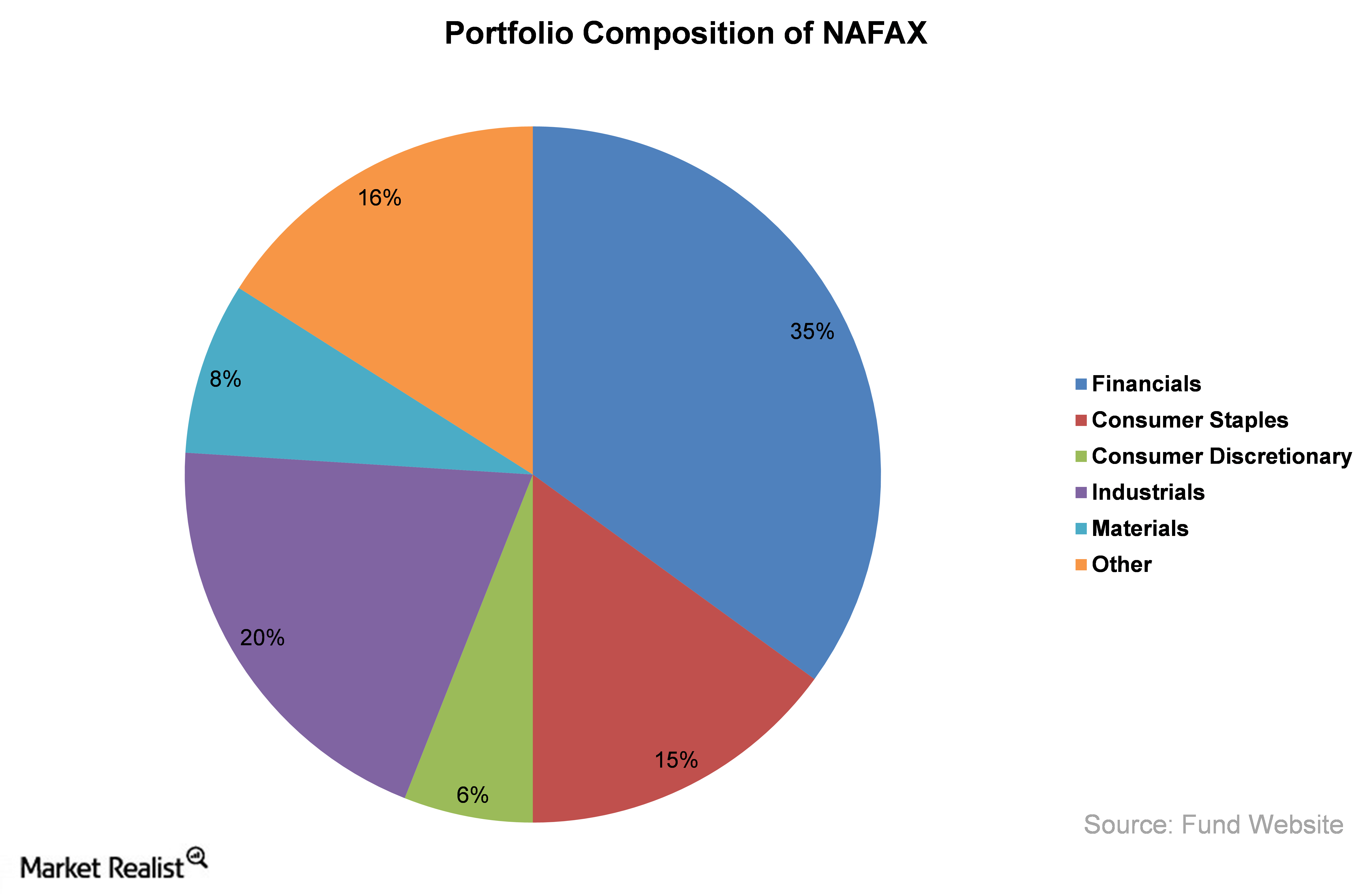

The Nile Pan Africa A Fund: Negative Returns for 5 Years

The Nile Pan Africa A Fund (NAFAX) invests at least 80% of its portfolio in the stocks of Africa-based companies. The majority of the fund’s exposure is in South Africa.