Lloyds Banking Group PLC

Latest Lloyds Banking Group PLC News and Updates

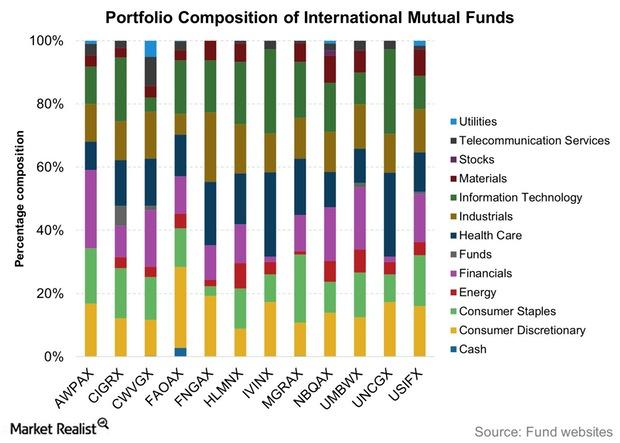

Is It Time to Invest in International Funds?

2016 has mostly been about macro trends, thus presenting a different set of challenges for active fund managers who mostly focus on companies rather than economic and sector trends.

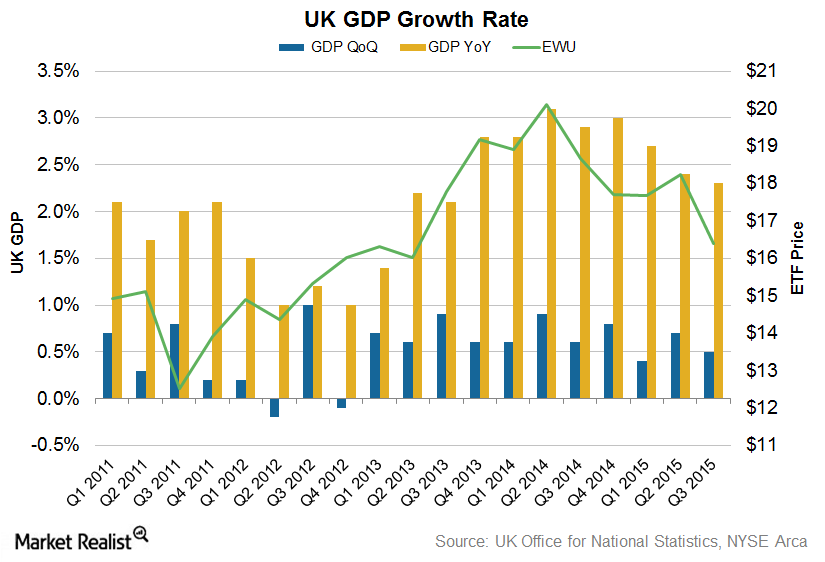

Rise in Household Spending Provided Respite for UK Economic Growth

With household spending gathering pace, it could be an important growth driver for the United Kingdom’s economic growth.