Interpublic Group of Companies, Inc

Latest Interpublic Group of Companies, Inc News and Updates

Why Google Is Not in Favor of Ad Agency Disintermediation

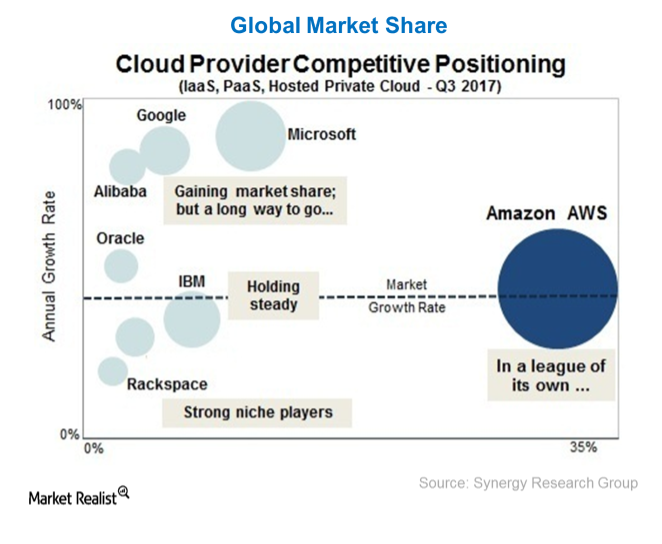

In the cloud computing industry, Google is behind market leaders Amazon (AMZN) and Microsoft (MSFT) and it is trying many strategies to bolster its position.Consumer Must-know: An overview of Interpublic Group’s businesses

Interpublic Group’s (IPG) companies specialize in consumer advertising, digital marketing, communications planning and media buying, public relations, and specialized communications disciplines.