Icahn Enterprises LP

Latest Icahn Enterprises LP News and Updates

How Icahn Enterprises Turned Its Home Fashion Segment Around

Icahn Enterprises (IEP) conducts its Home Fashion business through its indirect wholly owned subsidiary, WestPoint Home.

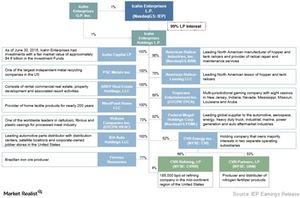

A Look at Icahn Enterprises’ Business Model

Icahn Enterprises’ investment strategy involves identifying and purchasing undervalued businesses and assets at distressed prices.