Intercontinental Exchange Inc

Latest Intercontinental Exchange Inc News and Updates

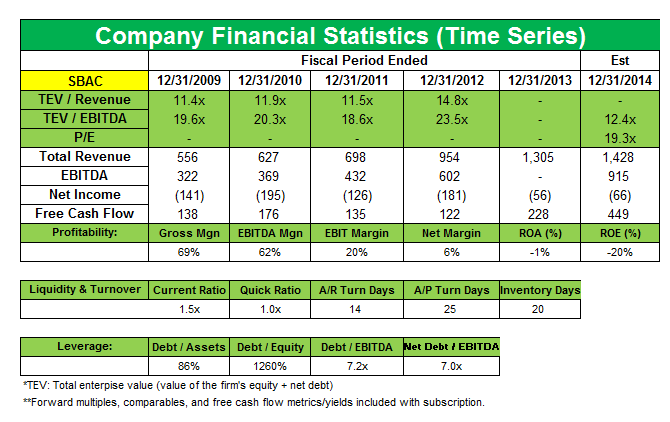

Why did Lone Pine Capital buy a stake in SBA Communications?

SBA Communications Corporation is a 2.11% position initiated by Lone Pine Capital in 4Q 2013.Financials Omega Advisors buys stake in IntercontinentalExchange

Omega Advisors opened a new 1.36% position in Intercontinentalexchange (ICE), a leading operator of global markets and clearing houses, in the fourth quarter.