Hitachi Ltd. (HTHIY)

Latest Hitachi Ltd. (HTHIY) News and Updates

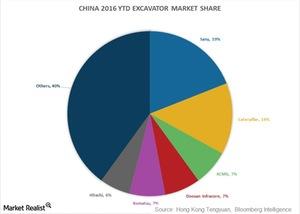

Caterpillar Doubles Its Market Share in China’s Shrinking Market

In 2012, Caterpillar (CAT) had a market share of 7% in the excavator manufacturing industry. Its share doubled to 14% YTD in 2016.

What’s Stanley Black & Decker’s Market Position?

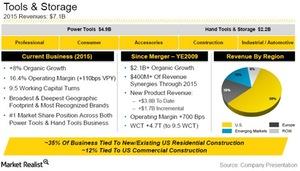

Stanley Black & Decker (SWK) has a stupendous record of launching at least 1,000 products every year at an average of three products a day.

What Are Stanley Black & Decker’s Business Segments?

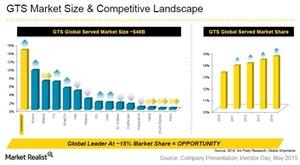

Stanley Black & Decker (SWK) markets its products through three business segments: Global Tools & Storage, Security, and Industrials.