Host Hotels & Resorts Inc

Latest Host Hotels & Resorts Inc News and Updates

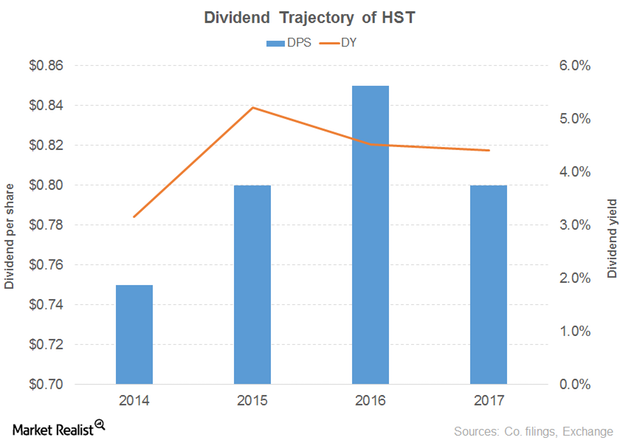

Host Hotels & Resorts’ Dividend Yield over the Years

Revenue and earnings Host Hotels & Resorts (HST), a hotel REIT, is involved in the possession and operation of US hotel properties. The company’s revenue was almost flat in 2015 and 2016, driven by rooms and food and beverages. Its operating costs and expenses rose 1%–2% in 2015 and 2016., while its interest expenses fell 32% […]

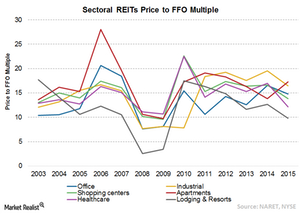

Most of the REITs Are Trading near Historic Multiples

The most common way of calculating the relative value of a REIT is the price-to-FFO multiple. FFO is widely used because it’s the main earnings metric for REITs.